At the start of 2020, Brent crude oil was trading at almost 70 dollars/barrel; by April 2020, it had fallen to 20 dollars/barrel, contributing to the pandemic-induced economic crisis already faced by countries that depend upon oil exports. As of June 2020, it remains too early to determine the future of oil prices with any degree of confidence, or the impact of the pandemic on international relations, as the health-related aspects of the pandemic are still in a state of flux. Nevertheless, we are in a position to make more definitive forecasts regarding the future perceptions of global oil markets, among policymakers, journalists, and the general public.

Historical Misperceptions of Global Oil Markets

In all domains, humans have an affinity for conspiracy theories,[1] and global oil markets are no exception. This section describes some of the common myths and offers an explanation for them.

Common Myths

The most prominent myth in the world of oil markets is that OPEC has been a historically effective cartel. This belief is reflected in many common quotes. For example, Frederick Smith, the founder and CEO of FedEx, said: “There is no free market for oil. It’s controlled by a cartel: OPEC.”[2] In 2001, with the US economy undergoing a recession and OPEC declaring that it would cut production, US President George W. Bush said: “Our economy is bumping along right now and a run-up in energy prices will hurt. Surely the OPEC leaders understand that. I think they do.”[3]

This perception has become so mainstream that the oligopoly chapter of virtually every introductory economics textbook cites OPEC as an example. However, analyzing real oil production data—an exercise assiduously performed by Jeff Colgan[4]—reveals a completely different picture. During the period 1980-2009, quota adherence levels among OPEC’s members were an anemic four percent, with most compliance being attributable to technical problems curtailing production, rather than voluntary reductions in production. Moreover, both the oil production and oil investment of OPEC members was statistically indistinguishable from that of non-members. Countries such as Indonesia entered and left the oil-producing club, with no discernible impact on their oil-market activities.

The unique exception to this rule was Saudi Arabia, which has historically maintained significant excess capacity. This was largely the result of a geostrategic pact with the US and western countries, more generally. In exchange for security and other forms of geopolitical support, Saudi Arabia would maintain the ability to quickly increase production should the market suffer a major supply disruption, as occurred during the Iraqi invasion of Kuwait in 1990, to avoid the sort of oil price spikes that caused massive damage to western economies during the 1970s.[5] Thus, non-economic interests nominally accounted for Saudi Arabia’s willingness to cut output.

OPEC’s difficulty in operating as an effective cartel is unsurprising. Cartels are notoriously unstable even under ideal conditions,[6] and global oil markets are almost the worst possible environment for oil producers to coordinate activity. There is a large number of producers; monitoring other producers’ production is difficult, producers have heterogeneous cost structures and levels of fiscal pressure, and market demand is unstable.[7] In addition, although OPEC is an international organization, it has zero executive power when it comes to holding quota-violators accountable. The worst punishment that can be imposed on a quota cheat is for other members to cheat in response, known as mutual enforcement,[8] a recipe for a cartel to quickly unravel.

If OPEC is essentially a paper tiger, then how has it managed to maintain a reputation for being the bane of western economies?

Moving on, many of the other myths surrounding global oil markets revolve around Saudi Arabia. Historically, it has been the scapegoat for rising oil prices. More recently, it has also been accused of recklessly flooding oil markets in the pursuit of geopolitical goals. In particular, in 2014, when oil prices began to fall sharply, Saudi Arabia’s refusal to cut output was somehow interpreted as an attempt to flood the market.

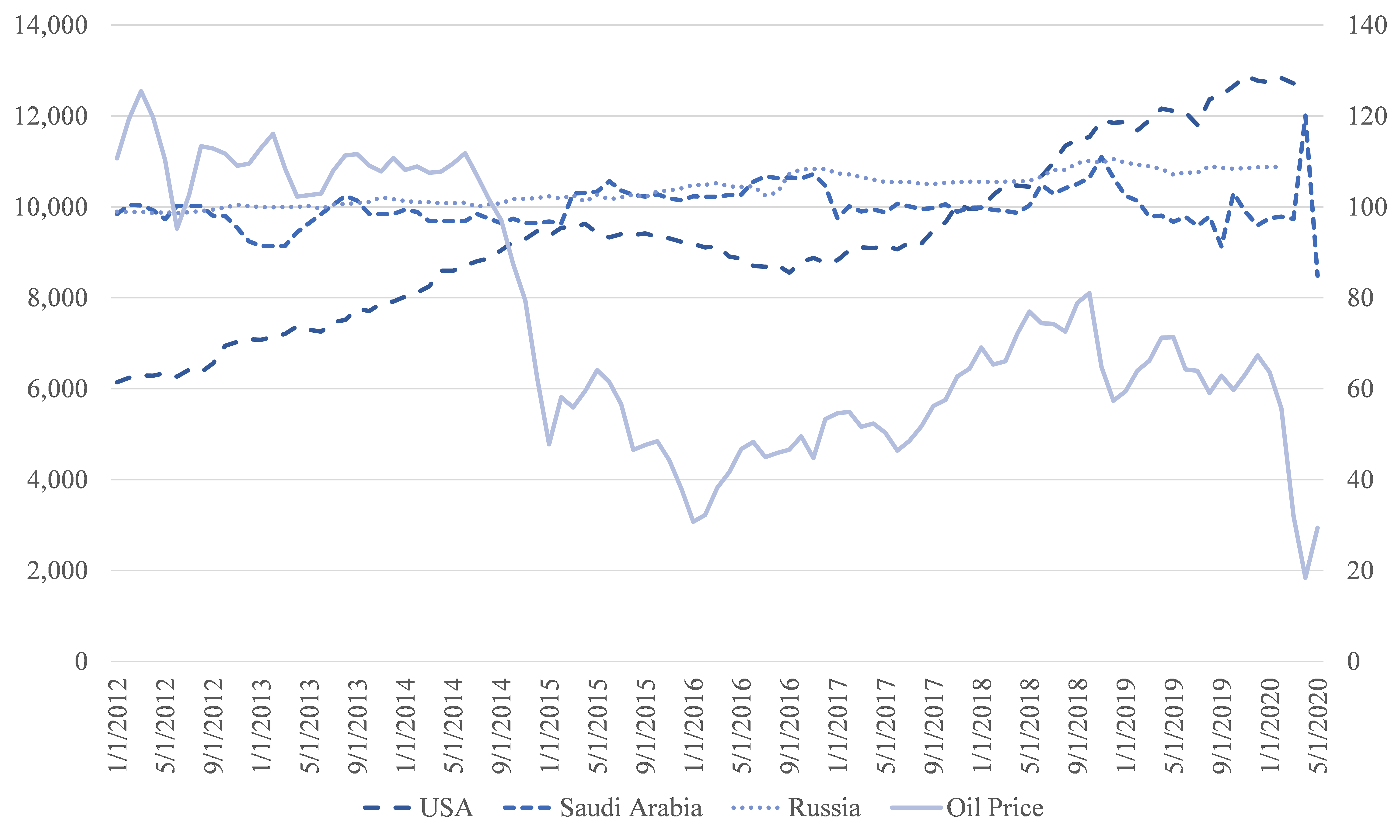

Figure 1 shows global oil prices and the oil production of the world’s three biggest oil producers: Russia, Saudi Arabia, and the US. Figure 2 shows oil prices and global oil demand and supply. Taken together, several features stand out from these figures.

Figure 1: Oil Production (left axis; thousands of barrels/day) and Brent Oil Prices (right axis; US$/barrel), 2012-2020

Source: Trading Economics

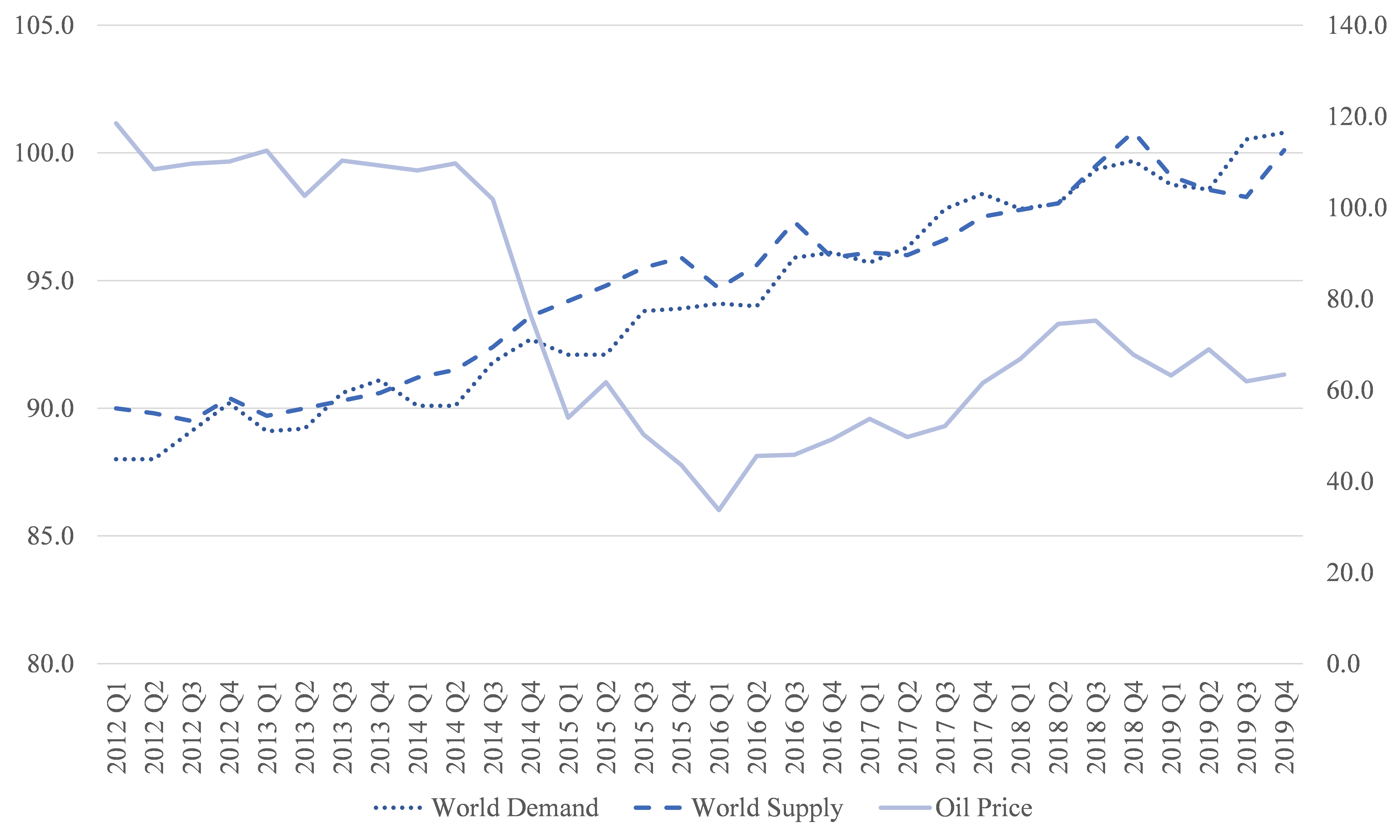

Figure 2: Global Oil Demand and Supply (left axis; thousands of barrels/day) and Brent Oil Prices (right axis; US$/barrel), 2010-2019

Source: OPEC

First, Saudi oil production is generally quite stable, and the contribution that variation in Saudi oil production makes to the variation in global oil production is very small throughout the period 2010-2019. Thus, if oil supply is affecting oil prices, then changes in Saudi Arabian oil production are not the reason.

In fact, as seen in the period leading up to 2014, most of the increase in global oil production is attributable to the US shale oil revolution, during which Iraq and Libya were also recovering after the Arab Spring disrupted production.[9] A significant cut to Saudi production at the end of 2016 did contribute to rising prices, but this was part of a coordinated OPEC+ cut that included significant decreases by Russia and other countries.[10] At the same time as the OPEC+ cut, however, US shale oil resumed its upward trajectory and, by the end of 2019, it became the primary cause of the supply glut in global oil markets.

Second, much of the variation in oil prices can be attributed to variation in oil demand. In the context of the 2014 oil price crash, while the growth of oil demand slowed due to the Chinese economy weakening,[11] the general improvement since January 2016 was the result of the global economy strengthening led by the US, including the 2017-2018 tax stimulus.[12] In contrast, the deterioration from the end of 2018 is largely the result of the threat to the global economy caused by the Sino-American trade dispute.[13]

In fact, with the advent of shale oil, which is much more flexible and responsive to market conditions than conventional oil,[14] the US economy’s sensitivity to price spikes in global oil markets considerably diminished. Consequently, the unwritten pact with Saudi Arabia was no longer necessary. Upon realizing this, Saudi Arabia shifted to an oil production strategy that is much more consistent with a narrow set of commercial interests, free from geopolitical influence.[15]

To summarize, Saudi Arabia went from being the world’s swing producer, maintaining the excess capacity to curry favor with the US, to being a country that generally produces as much as it can profitably produce, with the exception of coordinated output cuts under the OPEC umbrella. This made Saudi Arabia essentially like all other oil producers.

Yet despite the data painting a very clear picture of Saudi Arabia’s minimal contribution to oil price movements during the last five years, the rhetoric of political leaders and media energy analysts depicts Saudi Arabia as an omnipotent oil king capriciously toying with global markets.

The conspiracy theories started in 2014, when Saudi Arabia’s decision to essentially freeze output while prices fell rapidly was somehow interpreted as a kamikaze attempt at taking out shale oil producers through an extreme form of predatory pricing.[16] In fact, a group of political leaders representing oil-producers in the US threatened Saudi Arabia with a lawsuit for its cumulative manipulation of oil markets, though ironically, the charge had switched from holding oil markets to ransom by restricting output to unfair dumping of oil.[17]

Others saw it as part of a pact with the US to damage Russia’s economy as punishment for its anti-western stance in Syria and Ukraine.[18] Some others imagined that Saudi Arabia was dumping oil to undermine its regional rival Iran.[19] As the data above indicate, these propositions were complete nonsense. The truth was so much more boring than bellicose tales of Machiavellian oil conspiracies.

Why Are These Myths So Persistent?

Jeff Colgan provides convincing reasons for the steadfastness of these oil market myths. He divides the key stakeholders into four main groups, and explains why each has an incentive to perpetuate these efforts at transforming the mundane into the fantastic.[20]

First, western policymakers. Since the 1970s, this group has surmised that blaming foreign oil conspirators for economic recessions is a politically valuable way of evading responsibility for their own mismanagement of the economy.

Second, OPEC policymakers. Most of the relevance of the group’s members to global geopolitics stems from their influence on oil markets, and so drawing the ire of western policymakers served as confirmation of their power to policymakers as well as domestic audiences. This transformed them into willing scapegoats when western policymakers sought to demonize OPEC.

Third, energy journalists. This group has been happy to perpetuate the myth of oil market skullduggery, as it generates significantly higher levels of media interest than the truth, which is that oil was essentially a competitive market where countries produced as much as they could and prices were determined by demand and supply. Further, the fact that many energy journalists have no training in economics increases the likelihood of their succumbing to malicious as well as economically nonsensical and inaccurate depictions of oil markets.

For example, many use the term “dumping” to describe increases in Saudi oil production, without knowing that the term has a formal definition of selling a commodity at below the production cost. In fact, Saudi Arabia has incredibly low production costs, and at no point did global oil prices reach a level where producing oil was unprofitable.

Fourth, the general public. This group lacks the knowledge of economics and energy markets necessary to understand what is going on, and is therefore happy to follow the haphazard consensus that has emerged between the other three stakeholders.

In the case of Saudi Arabia being seemingly singled out, there are additional factors at work. First, the Saudi government has historically preferred to keep a low profile rather than allocating a large amount of little resources to manage its global image; this approach was fueled partly by the fact that Saudi Arabia’s oil wealth and good relations with western countries diminished the need for such management. Second, by being home to the two most important Islamic religious sites, and due to the important role that clerics play in the Saudi legal system, any antipathy toward Islam is amplified in the case of Saudi Arabia. Third, journalists tend to be left-leaning,[21] and left-wing movements tend to dislike monarchies, religion in politics, and what is perceived to be “inherited” and “unearned” resource income.

The Effect of the COVID-19 Pandemic

The COVID-19 pandemic’s long-term impact on oil markets is yet to be determined, however, it has already had a profound effect on the mythology surrounding oil markets.

Myths Old and New

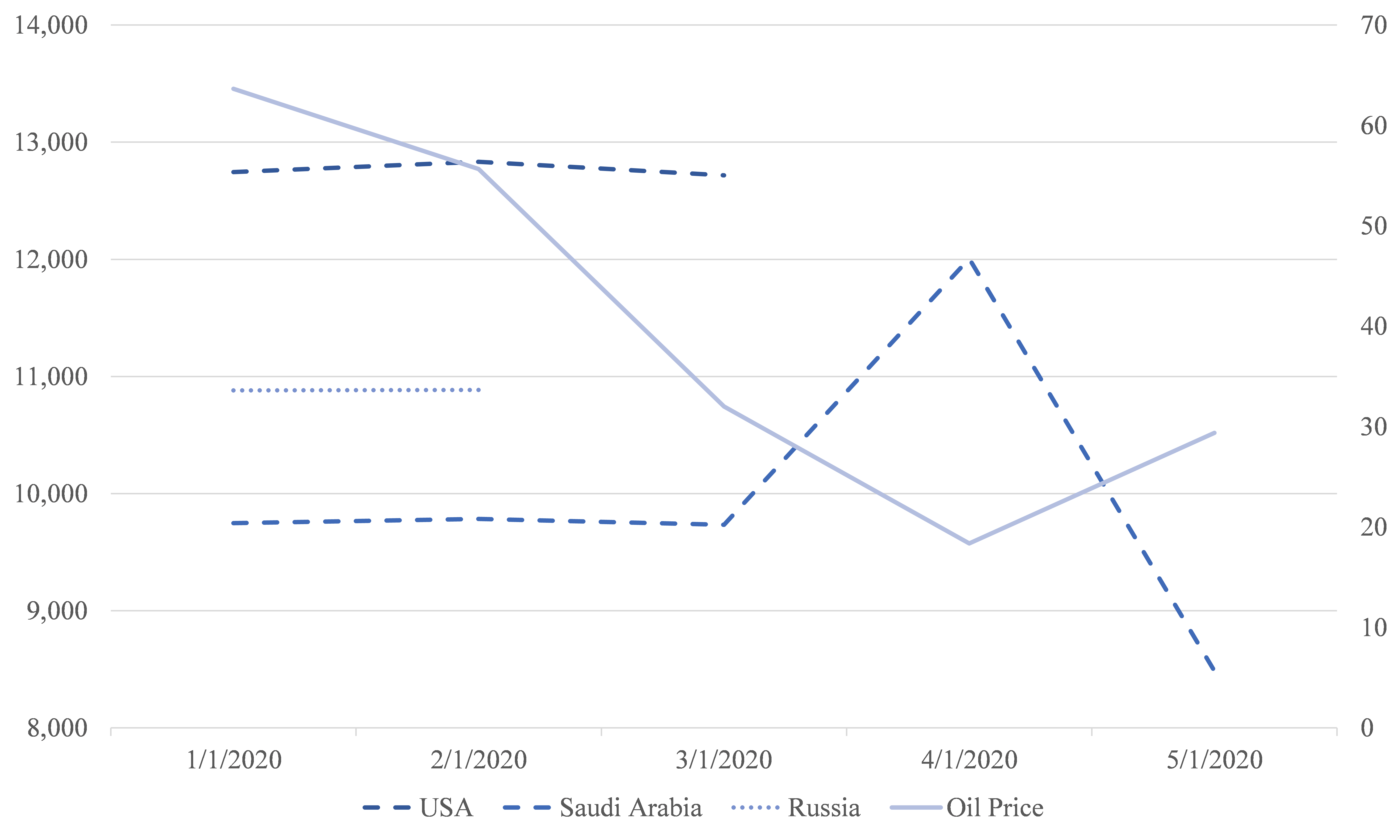

Figure 3 shows oil prices and production during 2020. For some time, Russian policymakers—a critical contributor to the stability of the OPEC+ agreement—have been articulating a desire to withdraw from the accord, and to return to a state of unrestricted oil production.[22] Oil prices began to fall at the end of January 2020 as the pandemic’s economic impact began to emerge, setting the stage for a critical OPEC+ meeting in March.

Figure 3: Oil Production (left axis; thousands of barrels/day) and Brent Oil Prices (right axis; US$/barrel), 2012-2020

Source: Trading Economics

The meeting ended without a deal, and during his exit interview, Russian oil minister Alexander Novak indicated that all OPEC+ members were free to produce as much as they wanted.[23] Saudi Arabia expressed its disappointment, and then proceeded to increase its production by approximately two million barrels, while oil prices continued to tank, reaching 20 dollars/barrel and, as a result, spawning a new wave of conspiracy theories.

The most popular myth was that Saudi Arabia was launching a price war—and a commercially unwise one— with Russia because Russia supposedly had deeper pockets,[24] and Saudi Arabia was overcome by the desire to exact vengeance.[25] Others interpreted the development as an under-the-table agreement between Russia and Saudi Arabia to torpedo shale oil through a staged price war.[26]

These fantastic depictions of events had two features in common. First, Saudi Arabia’s actions were the main cause of variation in oil prices. Second, Saudi Arabia was undertaking actions that were not only counter to global interests, but they were also counter to its own interests, presumably due to an error of judgment. Energy journalists argued that a unilateral output cut by the lowest cost producer that has a market share of around 10 percent would increase that producer’s profits, even though global oil prices were well in excess of its production costs—an argument indicating staggering levels of economic illiteracy.

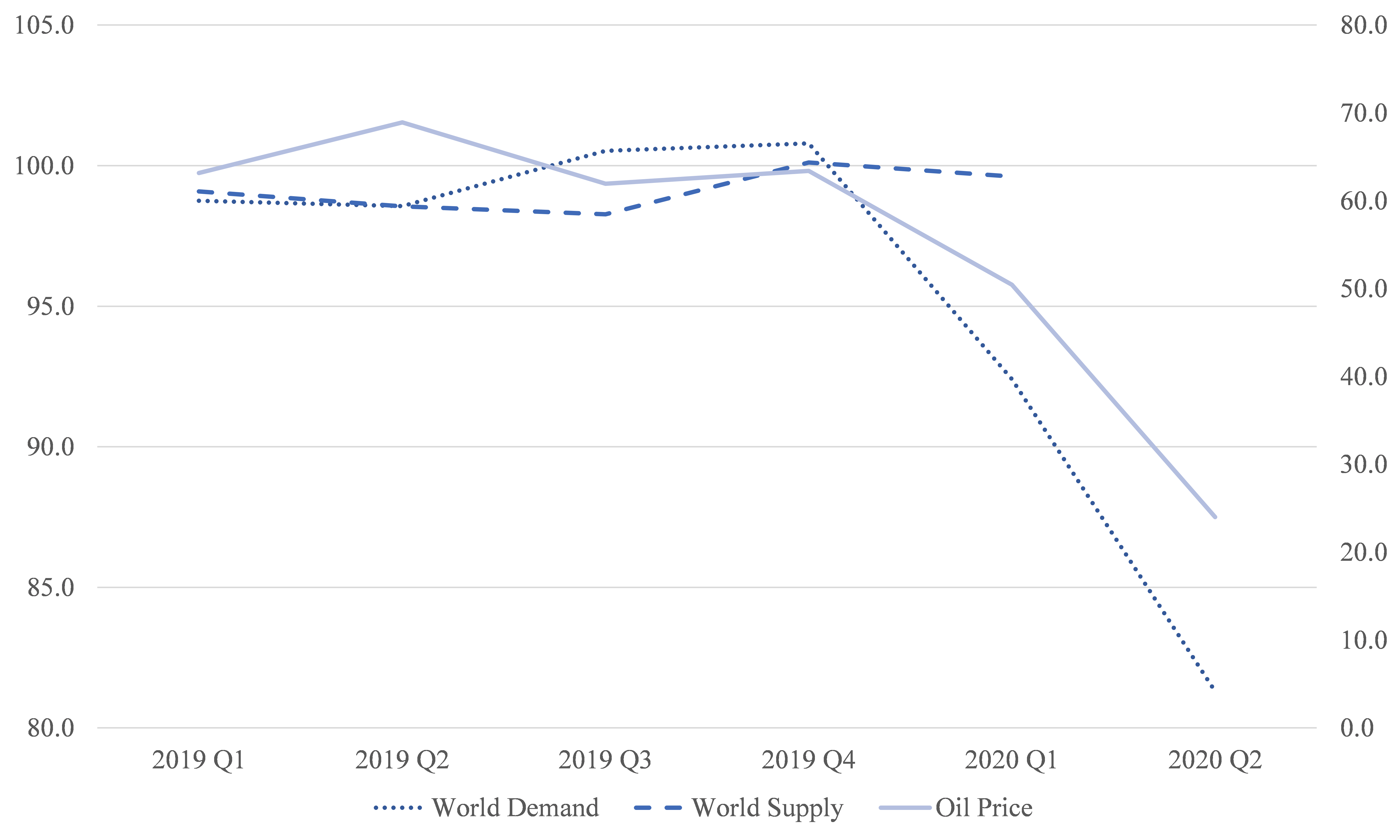

This narrative contributed to much Twitter-based handwringing by US President Donald Trump, and to new threats of action against Saudi Arabia for supposedly predatory behavior.[27] Yet, as ever, the actual explanation was much more mundane. Figure 4 shows the global oil demand and supply during 2019-2020, and indicates a similar explanation to the 2014 oil price crash.

Figure 4: Global Oil Demand and Supply (left axis; thousands of barrels/day) and Brent Oil Prices (right axis; US$/barrel), 2010-2019

Source: OPEC

Although the supply data for the second quarter of 2020 are not available, they are evidently irrelevant, as the primary cause of the fall in oil prices is collapsing oil demand, which is the result of the COVID-19 pandemic—especially the contraction in economic activity in China. When demand falls by 20 million barrels, even a complete shutdown of production by Saudi Arabia would leave an excess supply of 10 million in the market. Moreover, much of the fall in prices had occurred prior to the Saudi decision to increase output; thus, it is completely disingenuous to attribute the price collapse to a decision to increase Saudi output by around two million barrels. Therefore, the first quarter of 2020 seemed to perpetuate old myths. However, the second quarter led to some dramatic new developments with potentially profound long-term consequences.

First, with its post-2016 status as the world’s largest oil producer, and due to the susceptibility of its political system to the influence of lobbying groups, such as those representing oil producers, the US has been firmly in favor of higher oil prices (despite still being a net importer of oil). The US was therefore willing to contribute to a coordinated output cut under the G20 umbrella (Saudi Arabia is coincidentally the G20 host for 2020), along with other G20 members outside OPEC+. An accord, championed by US policymakers, thus materialized in April 2020.[28]

In the long-run, this should contribute to Saudi Arabia no longer being classified as the tyrannical ringleader in oil markets, and to a more widespread realization that it is simply a large producer with limited market power due to a ruthlessly competitive market. While the legal consequences of this development for the lawsuits that US policymakers keep threatening Saudi Arabia with is a matter for legal experts, it certainly undermines the moral case, since Saudi Arabia’s actions are now under a large, multilateral umbrella that features oil producers and consumers, including the US itself.

Second, OPEC++ (the term for the expanded accord) is facing major challenges in enforcement[29]—challenges that are to be expected for all the reasons described earlier. While it is too early to know for sure if quota cheating can be contained, a failure could represent the end for the myth of OPEC’s hegemony. While the organization may persist, the rhetoric among oil-exporting and importing policymakers and, among energy journalists, will likely permanently shift away from describing OPEC as an entity that can hold the global economy to ransom.

Will Updated Perceptions Affect Global Oil Markets?

How might such developments affect oil markets? It is worth noting that, in general, speculators in financial and commodity markets are less sensitive to fantastic media narratives than normal people are.[30] In the case of oil, this translates to markets being largely unaffected by OPEC-related hype.

This is unsurprisingly the result of professional traders having high levels of knowledge and experience, and the high stakes that they face. There is a large literature in economics supporting such findings.[31] In contrast, energy journalists are unlikely to suffer any adverse effects from propagating conspiracy theories; in fact, they might even gain readers and social media followers since such theories are more likely to pique readers’ curiosity.[32]

However, during unprecedented crises, such as COVID-19, professional traders become more susceptible to behavioral anomalies such as herding.[33] This is reflected in the high levels of volatility exhibited by financial markets in 2020,[34] including oil.[35] Moreover, this was also seen in oil market traders’ strong reaction to Trump’s tweet.[36]

In this context, one potential impact of the gradual withering away of the aforementioned oil market myths is lower levels of volatility, especially during times of great uncertainty. As an illustration, the markets for mundane yet important commodities, such as wheat and copper, have exhibited far lower levels of volatility during COVID-19. While there are several structural reasons for that difference, it is likely that the absence of fantastic narratives about cloak-and-dagger producer meetings contributes to the higher levels of stability.

If, as is likely to be the case, coordinated management of oil markets ultimately fails, along with the myths surrounding OPEC and Saudi Arabia, and markets become even more competitive, this could contribute to the trend of higher-cost producers exiting from the market and continued low investment in the oil sector.[37] Such developments could in turn generate upward pressure on long-term oil prices, but there are too many other factors at play—such as efforts at decarbonizing the economy and decreasing demand for global aviation—to make a definitive prediction.

Conclusion

Predicting the long-term economic impact of the COVID-19 pandemic is, at this point, mostly idle speculation. However, one area where developments have been more tangible is regarding oil-related myths and conspiracy theories. Dr. Seuss once quipped: “I like nonsense, it wakes up the brain cells. Fantasy is a necessary ingredient in living; it’s a way of looking at life through the wrong end of a telescope. Which is what I do, and that enables you to laugh at life’s realities.”

In that case, he would have surely liked oil markets, as the past four decades have seen a massive exaggeration of the strength of OPEC, and a comical characterization of Saudi Arabia as a capricious oil-market villain. The much more boring reality is that Saudi Arabia is a small cog in a large machine, operating much like any other producer does in any competitive market: it makes its production decisions based on its commercial interests, and it realizes that unilateral production cuts are commercial suicide.

With the G20 efforts to manage oil markets, and the likely unraveling of the OPEC++ accord, it is likely that these two myths will finally be put to rest. This sets the stage for oil markets to become less volatile in the future, as all stakeholders will begin to focus more on market fundamentals—and less on conspiracy theories—in assessing the state of play, unfortunately denying Dr. Seuss the opportunity to laugh at life’s realities.

[1] Karen M. Douglas, Robbie M. Sutton, and Aleksandra Cichocka, “The psychology of conspiracy theories,” Current Directions in Psychological Science, Vol.26, No.6 (2017), pp.538-42.

[2] Margo D. Beller, “US Needs Plan to Cut OPEC Oil Imports: FedEx CEO,” CNBC, 16 April 2012, https://www.cnbc.com/2012/04/16/us-needs-plan-to-cut-opec-oil-imports-fedex-ceo.html

[3] “President Bush warns OPEC on production cuts,” Irish Times, 25 July 2001, https://www.irishtimes.com/news/president-bush-warns-opec-on-production-cuts-1.391394

[4] J.D Colgan, “The emperor has no clothes: The limits of OPEC in the global oil market,” Review of International Organizations, Vol.68, No.3 (2014), pp.599-632.

[5] Michael Renner and Paul Aarts, “Oil and the Gulf War,” Middle East Research and Information Project, July/August 1991, https://merip.org/1991/07/oil-and-the-gulf-war/

[6] Margaret C. Levenstein and Valerie Y. Suslow, “What determines cartel success?” Journal of Economic Literature, Vol.44, No.1 (2006), pp.43-95.

[7] M.C. Lynch, “Causes of oil price volatility,” The Journal of Energy and Development, Vol.2, No.1 (2002), pp.107- 41.ychology of conspiracy theories,"Virginia, USA. Economics at George Mason University. ica and the Republic of Macedonia," mers of conspiracy theories,"Virginia, USA. Economics at George Mason University. ica and the Republic of Macedonia," mers o

[8] Michihiro Kandori, “Social norms and community enforcement,” The Review of Economic Studies, Vol. 59, No.1 (1992), pp.63-80.

[9] Christiane Baumeister and Lutz Kilian, “Understanding the Decline in the Price of Oil since June 2014,” Journal of the Association of Environmental and Resource Economists, Vol.3, No.1 (2016), pp.131-58.

[10] Vladimir Soldatkin, Rania El Gamal, and Alex Lawler, “OPEC, non-OPEC agree first global oil pact since 2001,” Reuters, 10 December 2016, https://www.reuters.com/article/us-opec-meeting/opec-non-opec-agree-first-global-oil-pact-since-2001-idUSKBN13Z0J8

[11] John Lee, “China's Economic Slowdown: What are the Strategic Implications?” The Washington Quarterly, Vol.38, No.3 (2015), pp.123-42.

[12] Jeremie Cohen-Setton, Egor Gornostay, and Colombe Ladreit de Lacharriere, “Impact of the trump fiscal stimulus on us economic growth,” The Peterson Institute for International Economics, 6 April 2018, https://www.piie.com/blogs/realtime-economic-issues-watch/impact-trump-fiscal-stimulus-us-economic-growth

[13] Yan Xia et al., “Impacts of China-US trade conflicts on the energy sector,” China Economic Review, Vol.58, Issue C (2019), p.101-360.

[14] Hilde C. Bjørnland, Frode Martin Nordvik, and Maximilian Rohrer, “Supply flexibility in the shale patch: Evidence from North Dakota,” Norges Bank Working Paper 9/2017.

[15] Bassam Fattouh, Rahmatallah Poudineh, and Anupama Sen, “The dynamics of the revenue maximization–market share trade-off: Saudi Arabia’s oil policy in the 2014–15 price fall,” Oxford Review of Economic Policy, Vol.32, No.2 (2016), pp.223-40.

[16] Gaurav Agnihotri, “The Saudi Oil Price War Is Backfiring,” OilPrice.com, 2015, https://oilprice.com/Energy/Crude-Oil/The-Saudi-Oil-Price-War-Is-Backfiring.html

[17] Omar Al-Ubaydli, Interview by Tim Constantine, Capitol Hill Radio Show, 2016, http://www.omareconomics.com/mainstream-media/category/radio-interview/2

[18] Mark Mazzetti, Eric Schmitt, and David D. Kirkpatrick, “Saudi Oil Is Seen as Lever to Pry Russian Support from Syria’s Assad,” New York Times, 2015, https://www.nytimes.com/2015/02/04/world/middleeast/saudi-arabia-is-said-to-use-oil-to-lure-russia-away-from-syrias-assad.html

[19] Matt Egan, “Iran's hidden role in Saudi Arabia's cheap oil stance,” CNN Business, 3 December 2015 https://money.cnn.com/2015/12/03/investing/opec-oil-prices-saudi-arabia-iran/index.html

[20] Colgan (2014), pp.599-632.

[21] Tim Groseclose and Jeffrey Milyo, “A measure of media bias,” The Quarterly Journal of Economics, Vol.120, No.4 (2005), pp.1191-237.

[22] Gaurav Sharma, “Oil Market Takes Another Barmy Turn as Donald Trump’s Tweet Sends WTI Futures 32% Higher,” Forbes, 2 April 2020, https://www.forbes.com/sites/gauravsharma/2020/04/02/oil-market-takes-another-barmy-turn-as-donald-trumps-tweet-sends-futures-32-higher/#172d7c7877cc

[23] Sam Meredith, “OPEC+ fails to agree on massive supply cut, sending crude prices to 2017 lows,” CNBC, 6 March 2020, https://www.cnbc.com/2020/03/06/opec-meeting-coronavirus-weighs-on-oil-demand-as-oil-prices-fall.html

[24] Dina Khrennikova, Olga Tanas, and Bloomberg, “Why Saudi Arabia’s plan to punish Russia with an oil price war likely won’t work,” Fortune, 12 March 2020, https://fortune.com/2020/03/12/saudi-arabia-punish-russia-oil-price-war/

[25] Summer Said and Benoit Faucon, “Inside Saudi Arabia’s Decision to Launch an Oil-Price War,” Wall Street Journal, 10 March 2020, https://www.wsj.com/articles/saudi-russia-disclose-dueling-output-plans-amid-intensifying-oil-market-war-11583835347

[26] Antoine Halff, “Saudi-Russia oil war is a game theory masterstroke,” Financial Times, 1 April 2020, https://www.ft.com/content/1da60fa2-3d63-439e-abd4-1391a2047972

[27] Stephen Cunningham, “U.S. senators urge Saudis to calm oil market tensions,” World Oil, 17 March 2020, https://www.worldoil.com/news/2020/3/17/us-senators-urge-saudis-to-calm-oil-market-tensions

[28] David Sheppard, Anjli Raval, and Derek Brower, “G20 backs largest oil supply agreement in history,” Financial Times, 11 April 2020, https://www.ft.com/content/16ac91d8-42bf-4190-88de-f3d89b2b36f4

[29] Javier Blas, “Cheating on oil production quotas stalls this week’s OPEC+ meeting,” World Oil, 3 June 2020, https://www.worldoil.com/news/2020/6/3/cheating-on-oil-production-quotas-stalls-this-week-s-opecplus-meeting

[30] Jonathan Alevy, Michael Haigh, and John List, “Information cascades: Evidence from a field experiment with financial market professionals,” The Journal of Finance, Vol.62, No.1 (2007), pp.151-80.

[31] John A. List, “Does market experience eliminate market anomalies?” The Quarterly Journal of Economics, Vol.118, No.1 (2003), pp.41-71.

[32] Eddie Shleyner, “7 Scientifically Proven Ways to Get More Clicks on Your Content,” HubSpot, https://blog.hubspot.com/marketing/scientifically-proven-more-clicks-on-content

[33] Michael Bowe and Daniela Domuta, “Investor herding during financial crisis: A clinical study of the Jakarta Stock Exchange,” Pacific-Basin Finance Journal, Vol.12, No.4 (2004), pp.387-418.

[34] Scott R. Baker et al., “The unprecedented stock market reaction to COVID-19,” Covid Economics: Vetted and Real-Time Papers, Vol.1, No.3 (2020).

[35] Anupam Dutta et al., “Impact of COVID-19 on Global Energy Markets,” IAEE Energy Forum, 2020.

[36] Sharma, “Oil Market Takes Another Barmy Turn.”

[37] Anton Eser and Nick Stansbury, “Oil must face its future as a declining industry,” Financial Times, 13 June 2018, https://www.ft.com/content/bc84470a-6e65-11e8-852d-d8b934ff5ffa