DOI: 10.58867/TDCU6900

Decarbonizing energy will benefit Türkiye’s economy for the long-term, but this requires major investments from diverse financing sources, supported by policy reforms to harness synergies and address trade-offs with other development goals. By meeting growing demand with resilient, zero-carbon energy sources, Türkiye can begin the transition away from fossil fuels and improve public health and trade competitiveness in the process.

Energy has fueled remarkable growth and development outcomes in Türkiye. The economy’s energy-intensity and the carbon-intensity of electricity production to date come with significant costs and risks. Transformative opportunities remain to be tapped in renewables, energy efficiency and electrification, building on remarkable recent progress.

Approximately 70 percent of (gross) greenhouse gas emissions in Türkiye are energy-related, including from power, industry, transport and buildings. Within the energy sector, electric power generation is the largest individual source (27 percent of total gross emissions in 2020). As of 2021, Türkiye’s total energy supply was met by natural gas (31 percent), oil (27 percent), and coal (25 percent), while energy supply from wind, solar and other renewable energy sources accounted for 16 percent. Energy and carbon intensity, at 145 ktoe/US$ 2015 and 440 g CO2e/kWh respectively, are above the European Union (EU) averages (88 ktoe/US$ 2015 and 229 g CO2e/kWh respectively), while Türkiye’s electricity production is now less carbon-intensive than the EU average.

Türkiye has accomplished successful sector reforms over many years to develop and transform the energy sector, including on energy efficiency and renewables. As part of its broader response to inflation, Türkiye’s acceleration of energy efficiency investments made it second among Organization for Economic Co-operation and Development (OECD) countries, in terms of improvement of energy intensity, in 2021.

Türkiye has also tripled renewable energy capacity in the last decade, to become the fifth largest renewable energy generator in Europe and the twelfth largest in the world. As of November 2023, installed capacity of all renewables (including hydropower) reached an historical high of 58.5 gigawatts (GW), or 55.2 percent percent of total installed capacity. The share of all renewable energy in total electricity generation increased from 32.4 percent in 2018 to 43.5 percent in 2022, exceeding the original target (set in 2019) of 38.8 percent by 2023.[1]

Türkiye’s 2022 National Energy Plan targets a further tripling or more of solar and wind capacity over the next decade to achieve 82.5 GW of total solar and wind generation capacity by 2035, adding around 60 GW between now and then.

However, Türkiye has a substantial coal lock-in outlook, with a large pipeline of coal capacity (32 GW in 2020). This is mainly based on exploiting the local coal resources (estimated at 17.3 billion tons), composed mainly of lignite, which is of low calorific value.

Türkiye is heavily exposed to supply disruptions and price volatility in global and regional energy markets, and to the consequences of global crises like the Russian invasion of Ukraine. Over the past two decades, primary energy consumption has more than doubled. Most energy supply now depends on sources outside the country. Up to 75 percent of Türkiye’s energy demand depends on imports, including 99 percent of gas and 93 percent of oil. Over the past decade, coal imports have tripled and are now greater than domestic production. In 2021, energy accounted for almost 20 percent of Türkiye’s total imports, contributing to massive current account deficits (US$50.7 billion). This constitutes a macroeconomic and fiscal challenge, in addition to an energy security risk.

Energy infrastructure and supply chains are also vulnerable to risks from geophysical hazards, like the February 2023 earthquakes, as well as extreme weather events and temperatures, compounded by burgeoning impacts of climate change.

Energy, like other sectors, has also seen high consumer price inflation (around 137 percent for 2022), investments hit by currency depreciation and corporate and banking sector vulnerabilities, compounded by the effects of the crises. Türkiye has mature social assistance programs to support poorer households, who tend to spend a larger proportion of their income on necessities like energy, so are often more sensitive to price increases. However, state capital injections to natural gas, petroleum and electricity production state-owned enterprises (SOEs), to lower inflationary pressures, has also posed fiscal risks. In 2020, subsidies to coal-power generation amounted to $475 million including tax reductions for electricity production, in addition to direct spending for exploration.

Türkiye’s primary objective for the energy sector, as presented in the 12th Development Plan, is to maximize self-sufficiency by using domestic and renewable energy resources, based on the 2053 net zero emission goal, along with uninterrupted, high-quality, sustainable and secure supply of energy at affordable costs. Further, the country aims to diversify energy supply sources and achieve a competitive structure through developing nuclear electric power, boosting energy efficiency, integrating new technologies, and strengthening their strategic position in international energy trade.

Pathways to Decarbonize Power in Türkiye

There are many possible paths for an energy transition to net zero. To inform discussion, the World Bank performed an exploratory analysis to identify policy and investment priorities to deeply decarbonize Türkiye’s power system. Two scenarios have been studied for the 2022 Country Climate and Development Report (CCDR), using the World Bank’s Electricity Planning Model—a power system planning model that includes capacity expansion and unit dispatch—to understand the implications of different levels of emissions reduction on the capacity and generation mix, given assumptions about demand growth and available technologies.

The first scenario is a least-cost expansion with recent government targets scenario (LGT). Used as a reference case,this scenario assumes Türkiye’s renewable energy targets as of mid-2022[2], the completion of the 4.8-gigawatt Akkuyu nuclear power station, and utility forecasts of demand growth.

A second scenario is the illustrative ‘resilient net-zero pathway’ (RNZP) toward the 2053 objective, shown in figure 1 below. This is just one possible path consistent with Türkiye’s long-term target, and involves inevitable simplifications (e.g., adaptation to climate impacts was not modelled). More analysis and work is needed to settle on the best possible path, distribution of action across sectors, and preferred policies and investments.[3] However, analyzing this RNZP is useful for exploring challenges, policy options, costs, and benefits.

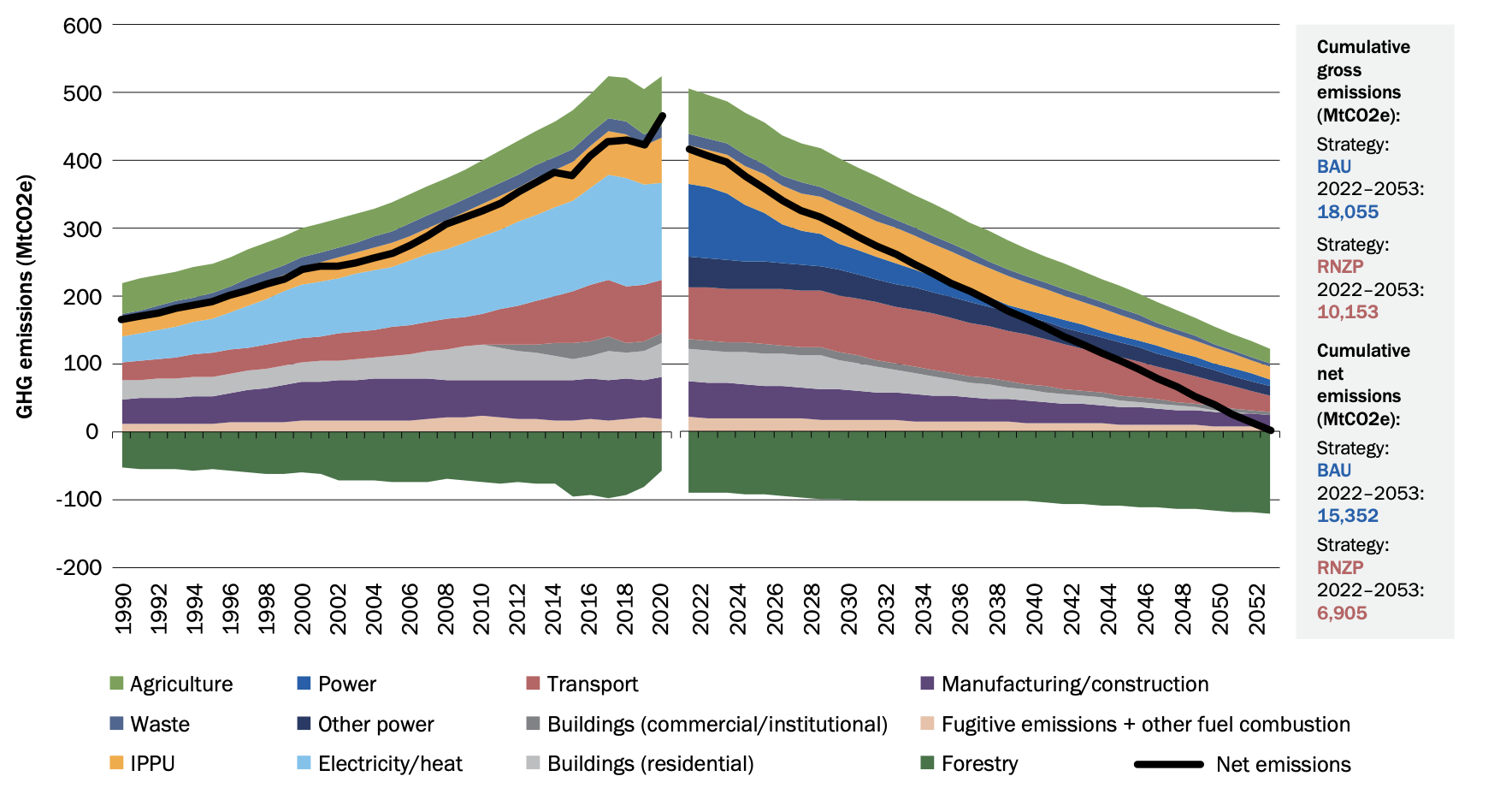

Figure 1: Historical emissions (left) and RNZP emissions, consistent with the 2053 target (right)

Source: World Bank staff calculations, based on Government of Türkiye (2022).[4]

Notes: BAU = business as usual; RNZP = net zero pathway; IPPU emissions are assumed unchanged until 2030; emissions in sectors other than power, transport, residential buildings, and forestry are assumed to reduce between 68 and 69 percent by 2053.

The RNZP scenario assumes: deep decarbonization of the power sector by 2040; energy efficiency (from 2022) and electrification (from 2030) in residential buildings; modal shift and electrification in passenger and freight transport; changes in land use and practices to maximize negative emissions from forest landscapes; and emissions reduction efforts in the rest of the economy (industry, agriculture, waste management, and water management).

The RNZP assumes a 45 percent emissions reduction in the power sector in 2030 and a 90 percent reduction by 2040 relative to LGT, in line with achieving the economy-wide net zero target of 2053. In addition to the LGT assumptions, RNZP assumes that carbon capture with sequestration for gas and coal-fired power plants is available after 2035 and includes additional demand from electrifying residential buildings and transport.

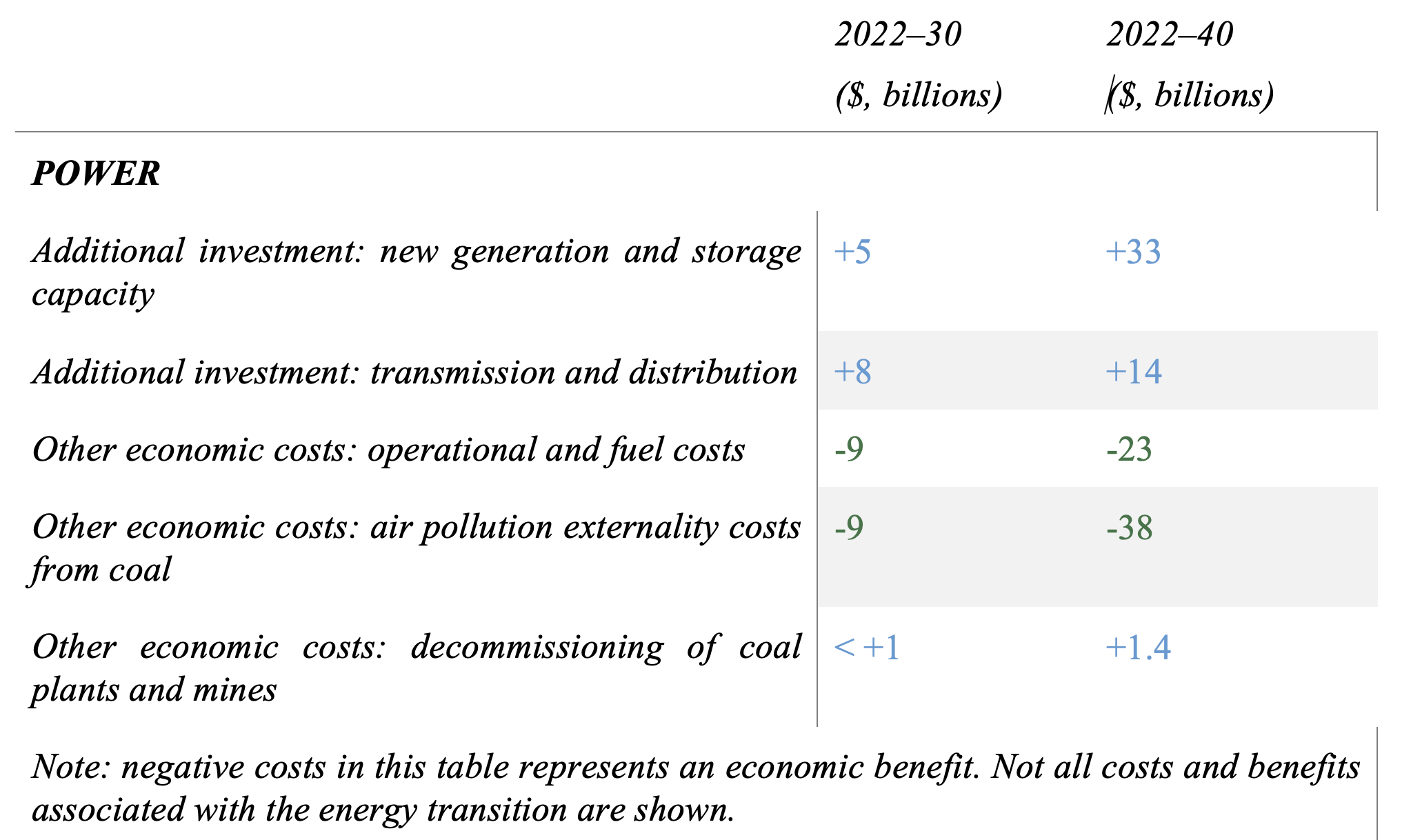

Compared with the reference scenario, which does not include specific climate objectives, Türkiye would need to invest an additional $68 billion over 2022–30 (in present value terms) to be on the RNZP (that is 1 percent of discounted cumulative GDP over that period). Over 2022–40, this number grows to $165 billion, or 1.2 percent of discounted cumulative GDP over the period. Table 1 summarizes key costs and benefits over time comparing the LGT and RNZP scenarios.

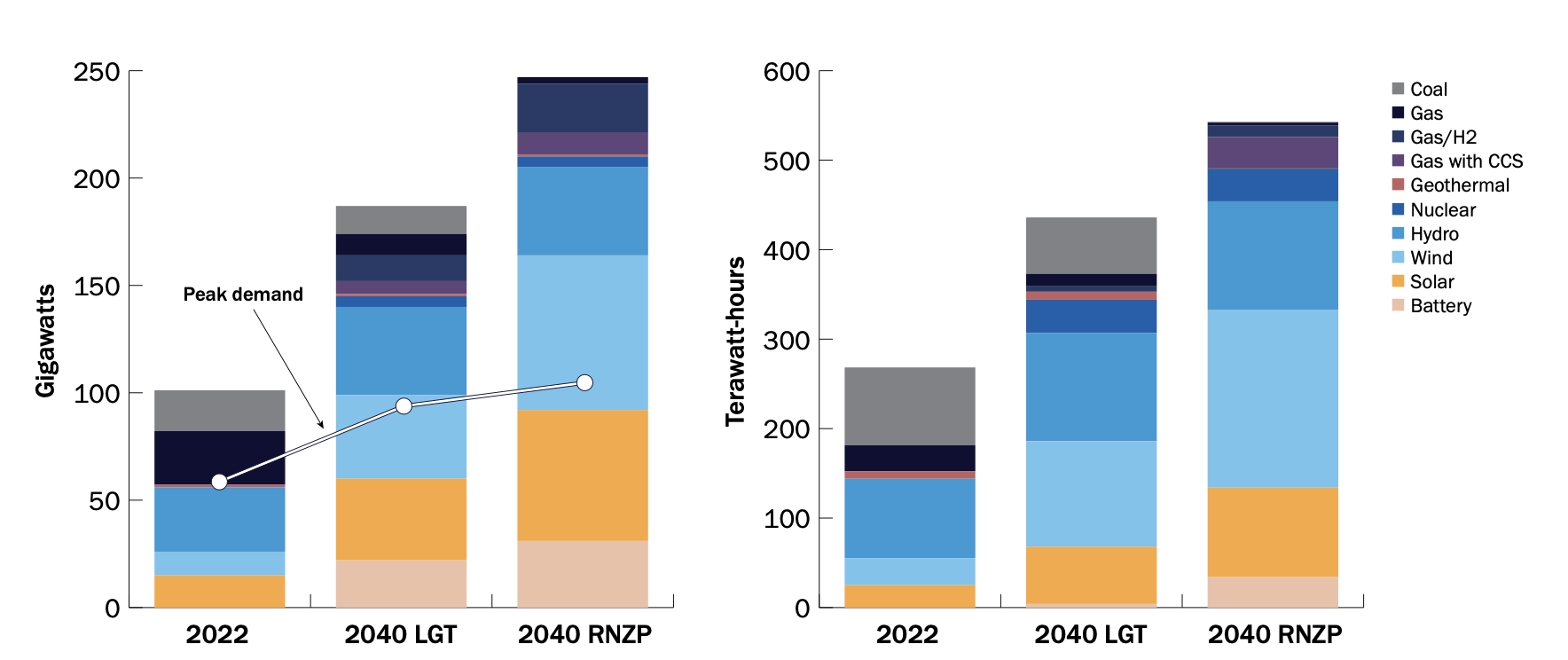

The RNZP scenario resulted in 60 percent of power generated by solar and wind, underscoring the importance of grid integration and storage (figure 2). New solar and wind investments are the cheapest way to meet new demand for energy and could meet most future power demand without compromising energy security, based on assumed availability of flexibility resources.[5] In this context, battery energy storage investments and policies to remunerate grid services are essential.[6]

Around 2030, Türkiye will need battery or pumped hydro storage to manage the increasing penetration of solar and wind and provide sufficient system flexibility. After 2030, some flexibility services could be provided by low-emission, flexible thermal generators which could run on natural gas or hydrogen, depending on the evolution of technology and the need for emissions reductions. In the RNZP, hydropower, geothermal, nuclear, and gas generation with carbon capture provide the stability of the power system. The RNZP sees 9.6 gigawatts of battery storage installed by 2030. The relative role of various technologies implemented after 2030, such as battery storage and carbon capture, will have to be reviewed over time, as the evolution and cost of these technologies remain uncertain.

Investments on energy efficiency can bring significant benefits at least cost. A sensitivity on the RNZP scenario has indicated that reducing the assumed electricity demand growth in half could reduce the investment needed to achieve deep decarbonization by 20 percent avoiding US$ 1.3 billion on investment each year.

Figure 2: Türkiye’s power system capacity and electricity generation mix, 2022 and 2040

Source: World Bank staff estimates

Notes: Gas/H2 = hydrogen gas; CCS = carbon capture and storage.

Table 1: Investment needs and economic costs in the RNZP (additional compared to baseline)

Notes: All amounts are discounted using a 6 percent discount rate.

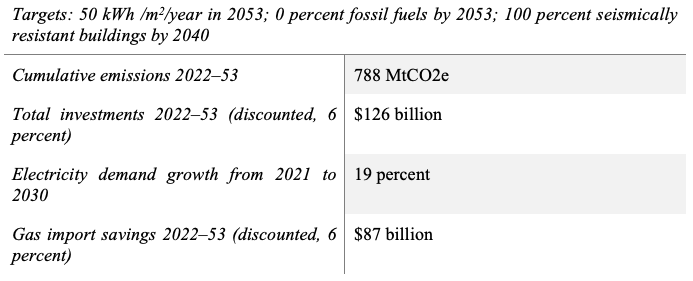

The buildings sub-sector is expected to support decarbonization through its vast potential for electrification and energy efficiency. [7] Without further energy efficiency and heating improvements, energy demand from buildings will likely more than double by mid-century due to expected population and economic growth. Without prioritizing energy efficiency, electrification alone would bear more than double the cost of decarbonization of the building sector. In the short-term, stringent energy efficiency standards in buildings codes is crucial for avoiding costly retrofits later.

Table 2: Emissions, investment needs, electricity demand growth, and gas import savings in the RNZP scenario for residential buildings

Notes: Investments are additional to a business-as-usual scenario. MtCO2e = million tonnes of carbon dioxide equivalent.

Electrification of transport creates an opportunity to decrease emissions since transport accounts for 17 percent of Türkiye’s emissions greatly in the form of road transport. If charging is left uncoordinated by 2040 the demand from e-mobility will require system investments in the order of 23GW mainly in the form of wind and battery storage at a cost of US$ 20 billion excluding the cost of charging infrastructure. Vehicle owner’s charging behaviors should be coordinated. Coordinated charging reduces investment needs by US$ 3 billion by 2040 with greater savings in the next decade.

While scaling up clean energy to meet growing demand, preparing to transition from coal-fired power is also essential to achieve the government’s net zero target, and makes economic sense without compromising energy security. Deep decarbonization in the power sector implies Türkiye has to retire most of its coal power plants by 2040, build no new coal plants, and replace the energy with cleaner, affordable, and reliable alternatives. Analysis suggests that 6 gigawatts of coal-fired generation can be retired because of age or economics as soon as renewable energy, or zero carbon alternatives can be operationalized to replace the retired energy. An additional 13 gigawatts of coal plants must be retired by 2040 to achieve deep decarbonization in the power sector.[8]

The Decade Ahead

The RNZP illustrates the feasibility and overall benefits of aligning energy development with climate-related goals. Türkiye can achieve energy security through an accelerated pace of least-cost investments in domestic solar and wind—building on its recent track record and in line with its new targets—and investing in energy efficiency, battery and pumped storage, geothermal, and gas generation with carbon capture and storage (as well as completion of the nuclear plant under construction). This would enable the country to meet a doubling of energy demand by 2053 to fuel its growth ambitions, with the added benefit of lowering emissions and improving energy security by reducing reliance on imported coal, gas, and oil. Even without a carbon constraint, new coal power plants are neither needed nor the least-cost option to meet growing electricity demand. Renewables, which are cost competitive with coal, offer a better longer-term solution (when coupled with balancing technologies) for domestic energy supply and achieving energy security goals.

There is an urgent need to realign current energy policies because current trends are locking-in carbon-intensive patterns that will increase costs and create financial risks, such as stranded assets. Significant upscaling of renewable energy with a diversified power mix—including wind, solar, hydropower, geothermal, gas generation with carbon capture and storage, and nuclear—are needed as well as investments in energy storage, particularly battery energy storage, which the country has yet to start investing in. It is also important to end the costly support to domestic production and consumption of indigenous coal and stop the construction of new coal power plants, which would be at high risk of becoming stranded assets before the end of their lifetimes.

Among six short-term priorities recommended by the CCDR, the number one priority is to realign energy policies to decarbonize the power sector. This involves parallel efforts to: (a) scale up renewable energy; (b) deploy grid integration measures, particularly battery and pumped storage, remunerating storage services, and expanding and digitalizing transmission networks; and (c) ensure well-designed power markets, with careful consideration of implications for reliability and electricity prices. Moreover, revised standards and grid codes should consider increased climate risks (e.g wildfires, heat and flooding).

A related priority is to make the economy more energy efficient. This involves establishing a more ambitious National Energy Efficiency Action Plan to 2030 for transport, buildings, urban industry, and waste sectors, with (a) more stringent and well-enforced building standards and codes; (b) strategies and investments to support modal shifts in transport and transit-oriented urban development; (c) a national program for building renovations; (d) national schemes to support energy efficiency in factories, including energy audits and efficiency reporting, and improved recycling programs for metals, e-waste, and other waste; and (e) a progressive and coordinated shift toward electrification in industries, as well as space and water heating, coupled with rooftop solar schemes to offset impacts on the grid.

Finally, Türkiye can minimize social disruptions through a new energy security compact to ensure a just and inclusive energy transition. Such a strategy could (a) identify at-risk sectors and workers; (b) anticipate and prepare for retraining and reskilling needs; and (c) strengthen social protection systems to make them more reactive, flexible, and better able to absorb expected and unexpected shocks. This foundation can position Türkiye to: (d) not build new coal plants; (e) retire most existing coal power plants and mines by 2040 and compensating for lost future revenues; (f) support laid-off workers and affected communities; and (g) facilitate environmental remediation. Repurposing retired coal power plants and closed coal mines can not only lead to economic and energy transition, but also mitigate the social impacts and disruption of these closures.[9]

Table 3 presents sample milestones from the RNZP which the government can use as medium-term targets for its next NDC, as a basis for sectoral ministry and agency proposals and investment plans, or to allocate budgets, track progress, and report to Parliament and the population. As Türkiye’s tracks its progress towards current and new targets backed by strategic sectoral plans, the next challenge will lie in implementation.

Table 3: Summary of sample 2030 energy milestones for the illustrative RNZP

Further Reading

Republic of Türkiye. 2023. Twelfth Development Plan (2024-2028). Published in the Official Gazette dated 1st November 2023. https://www.resmigazete.gov.tr/eskiler/2023/11/20231101M1-1-1.pdf

World Bank. 2023a. Türkiye Systematic Country Diagnostic: The path towards high-income. Washington, DC: World Bank (forthcoming).

[2] Before the 2022 NEP was published.

[3] For example, in the 2022 NEP, 1.7 GW from domestic coal-fired plant is still expected to be included in the system by 2030, implying a need to accelerate a transformation of the power system post 2035.

[5] Under the RNZP, gas demand will gradually decline, but will pick up again after the mid-2030s. This will provide system flexibility to accommodate a high share of variable renewable energy with a very low-capacity factor, but it could be replaced by green hydrogen with cost reduction. Therefore, RNZP reduces dependency on gas imports compared with business as usual.

[6] Türkiye’s distribution sector is fully privatized, and while it has been successful in reducing losses and ensuring RE integration, on the back of the need for greater RE supply, continued investments in distribution are key.

[7] Sabanci University IICEC, “Turkey Energy Outlook 2020,” (Istanbul: TEO Book, 2020): 350.

[8] See World Bank Group, Türkiye Country Climate and Development Report, CCDR Series. © (Washington, DC: World Bank, 2022). http://hdl.handle.net/10986/37521 License: CC BY 3.0 IGO, for further estimates of costs associated with a transition from coal.