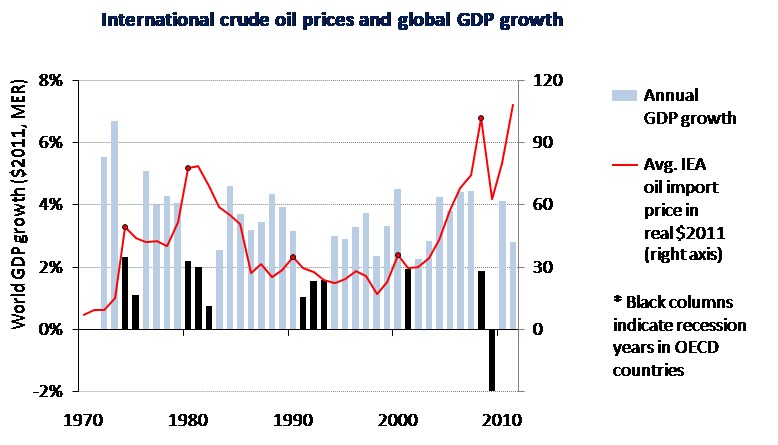

The relationship between sharp rises in oil prices (“oil price spikes”) and the world economy can be directly observed by mapping oil prices against world GDP growth. Nonetheless, ever since the 1970s, there has been an active debate among economists as to whether an oil price spike causes poor economic performance or is merely associated with poor economic performance. The debate began in the 1970s because, in the several decades before the 1970s, oil prices were relatively stable (why they were so stable is discussed later in the paper). Despite the debate, decades of relevant research on this topic make clear that oil price spikes cause economic dislocations through relatively well-understood mechanisms.[1]

As shown in Figure 1, past oil supply outages have caused sharp increases in oil prices and with them sharp decreases in world GDP growth. The price rise from the 1973 oil embargo preceded a four percent drop in world GDP growth. Within two years, world growth slid from over six percent to one percent. The oil-supply outage resulting from the 1979 Iranian Revolution doubled oil prices. Growth slid from four percent to two percent and, later, to below one percent.

Figure 1

Source: IEA, World Energy Outlook 2011

The spike in oil prices resulting from the 1990 Gulf War led to a drop in world GDP growth from over three percent in 1990 to one percent in 1991. GDP growth did not return to three percent until 1994. The price spike from 1999-2000 was followed by a drop in world GDP growth from over four percent in 2000 to two percent in 2001. The world economy appeared to survive the extended price rise from 2002 to 2007 until 2008 when it suffered its worst financial crisis since the 1930s. World GDP growth dropped from over four percent in 2007 to less than two percent in 2008 and then plummeted to negative two percent in 2009. While the 2008 recession followed a liquidity freeze, high oil prices were a partial cause of the financial crisis. Excessive construction lending had been made in locations that were dependent on low automobile commuting costs. After oil prices rose, these home-owners were the first to experience mortgage debt that exceeded their home’s market value and were also burdened by much higher commuting costs. Rapidly increasing oil prices did not just affect the housing market, but they also reduced automobile sales and economic activity in vacation and entertainment-focused regions. All of these consequences resulted in reduced household incomes after paying unavoidable fuel expenses. With reduced spending, important economic sectors contracted which caused dislocations of labor and capital. The worldwide real estate bubble enabled the economy to tolerate rising oil prices for a number of years. However, by 2007-2008, the strain of exponentially rising oil prices on disposable income, employment, and mortgage defaults contributed to the worst worldwide economic contraction in over 75 years.

The price rise from the 1973 oil embargo preceded a four percent drop in world GDP growth. Within two years, world growth slid from over six percent to one percent.

Is it a coincidence that there has been only one sharp annual reduction in world economic growth that was not preceded by an oil price spike?[2] Or, do oil price spikes cause declines in world economic growth? World GDP growth has remained above three percent, apart from the first two to three years following an oil price spike. Unless these episodes linking oil price spikes to poor worldwide economic growth are coincidences or a result of monetary authorities’ mismanaged economic policies, there must be a mechanism through which these oil price spikes cause such economic harm.[3] Reduced spending on other goods and services has multiplier effects that accelerate in later time periods. For example, Edelstein and Kilian found that a shock causing a one percent spending reduction produces a 2.2 percent reduction one year later.[4] As the economy adjusts to a new pattern of expenditures, transitional effects force the economy to operate below its potential output until full adjustments are made, such as inter-sectoral and inter-regional relocations of labor.

A major mechanism through which oil price shocks affect the economy involves the motor vehicle industry. Oil price spikes reduce spending on motor vehicles disproportionate to their effect on disposable income. The economic harm from decreased automotive sales cascades throughout the economy. Tracing impulses with a 1949-2012 statistical model, Santini and Poyer showed that real expenditures on motor vehicles declined immediately following a gasoline price shock, but well before subsequent declines in employment.[5] While automobile production is typically associated with the United States, Japan, Germany, and South Korea (they are the second to fifth largest automobile manufacturers), automobile production is widely distributed. The largest auto producer is China and, after South Korea, there are 11 countries, including Turkey, that produce at least one million motor vehicles per year.

The economic harm caused by oil price increases is not linear. Hamilton showed that oil price changes do not matter unless they set a new high relative to the previous three years.[6] This helps explain why oil price spikes, following a large oil supply outage, pose a particular risk to the world economy while more moderate levels of oil price volatility are more tolerable. Looking forward, there is little reason to be complacent about the economic damage that could be caused by future oil price spikes considering the continued risk of oil-supply interruptions in Middle Eastern and North African oil exporting countries. These risks have not significantly influenced oil prices from 2014 through 2017 because of abnormally high oil and petroleum product stocks.[7] With closer to normal world-wide stocks, supply risks are again cited as factors explaining recent crude oil prices increases despite comfortable supply demand balances.

Why Do Oil Prices Spike from Relatively Small Percent Reductions in World Oil Supply?

Small imbalances of supply and demand create large changes in price when demand and supply are not very responsive to oil price changes. Over time, consumers and producers can respond more effectively to price changes, but the short-term response tends to be more rigid. For example, if oil prices stay high for a number of years, the more efficient cars that consumers purchase will form a larger part of the vehicle fleet, reducing fuel consumption. In response to higher prices, people might also buy homes closer to where they work or get jobs closer to where they live. Oil producers will also respond to higher prices by increasing investments in new wells or developing new fields. However, the longer-term responses to higher oil prices do not help in the first three months after an oil supply interruption. It is over this brief period of time that oil prices spike and cause the dislocations that damage world economies.

The responsiveness of demand and supply to price changes can be quantified by estimating the price elasticity of demand and supply. Studies of the short-term price elasticity of oil and motor fuel which used data prior to the 1990s showed that, in the short term, a 10 percent oil price increase would bring about a three percent reduction in oil demand.[8] However, studies using recent data show that the short-term responsiveness to oil price changes is now much smaller. A 10 percent oil price increase is now estimated to only reduce demand by half percent or less.[9] One of the reasons why this has changed is the decline of oil used in electricity production. When oil had a more significant share of the power sector, there were other fuels that could be used instead of oil when oil prices rose. This contributed to a higher price elasticity of oil demand. However, since the 1970s, oil has become increasingly insignificant in the power sector. Now, the most important refined petroleum products are gasoline, diesel fuel, and jet fuel. Automobiles, trucks, and aircraft that use these fuels cannot switch to another fuel.[10] Thus, the only short-term response to higher fuel prices is to reduce the use of motor vehicles and air travel, something that statistical research and practical experience show only occurs when price changes are very high.

Rapidly increasing oil prices did not just affect the housing market, but they also reduced automobile sales and economic activity in vacation and entertainment-focused regions.

The price elasticity of demand is only half of the story. Rapid price changes from relatively small oil supply outages could be avoided if oil supply responded rapidly to higher prices. However, during the first three months of an oil supply outage, there is very little response on the supply side except increasing draw on industry oil stocks. Commodity markets send a clear signal to oil traders via the forward curve showing the future price at which oil can be bought or sold. Price spikes cause the forward curve to be backwardated. When it becomes significantly backwardated, parties are motivated to sell oil on the spot market since it commands a higher price compared to the oil which can be repurchased at a later date with a futures contract. Nonetheless, as helpful as stock drawdowns are to increase supplies after an outage, they have not prevented significant price spikes following past oil supply disruptions.

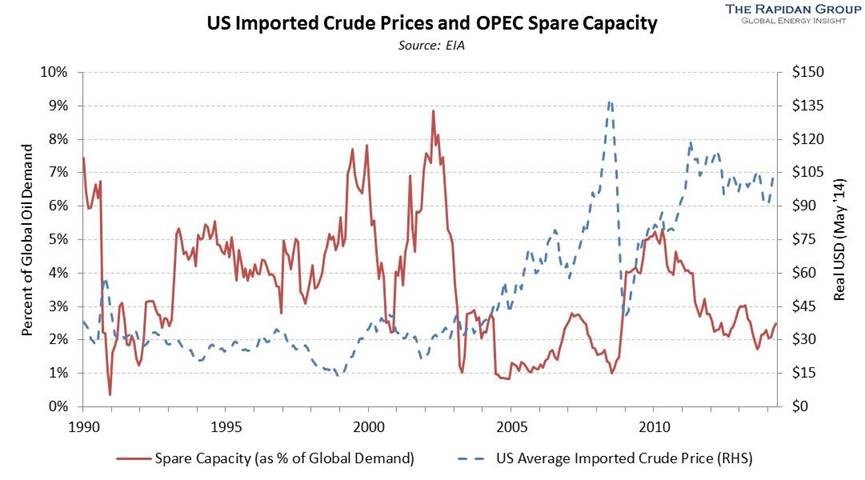

The Organization of the Petroleum Exporting Countries’ (OPEC) oil production reserves have not prevented oil price spikes in the past. Recent research has shown that during a period when OPEC spare capacity was significantly larger than it is today, OPEC has used its spare capacity to partially moderate oil price volatility.[11] Nonetheless, sharp economy-damaging oil price spikes still occurred. It takes too much time to bring OPEC spare capacity on line and market signals are weak that OPEC capacity will be forthcoming. The International Energy Agency (IEA) defines OPEC spare capacity as “the level that can be reached within 90 days and sustained for an extended period.” Since oil price shocks occur weeks after an oil supply interruption, increased production by 90 days is too late to prevent them. OPEC reserves are also less likely to play a similar role in the future. As shown in Figure 2, OPEC reserve production is much lower than it has been in past years.

Figure 2

Source: Rapidan Energy Group

Oil producers are also unable to respond rapidly. Conventional oil production has a very long lead time, which is measured in years, between investment and production. Since the marginal cost of pumping oil is always higher than the price of oil, oil wells produce at a constant rate to generate maximum revenue regardless of what the prices are. Consequently, oil companies cannot simply dial up more volume from existing wells. The only possibility for a rapid response of production from higher prices might come from US tight-oil producers. They can respond quickly to higher prices since the time from drilling to production is quick. Despite this, the time from tight oil well investment to production is still longer than three months: Too long to provide relief after an oil supply outage. In addition, despite the rapid response of US oil production to rising prices during 2016, various constraints, such as pipeline capacities from oil fields to refineries or export ports, are becoming more important and could further delay the response of US oil producers to future price spikes.

In response to higher oil prices, people might also buy homes closer to where they work or get jobs closer to where they live.

Taking both the price elasticity of supply and demand into account, the oil market is very brittle and prone to oil price spikes from relatively small unplanned oil supply outages, especially during the first three months after a supply interruption. Inelastic supply and demand along with relatively limited relief from stock draw or OPEC reserves mean that large price changes are required to balance world oil markets. These price spikes occur quickly and cause lasting damage to worldwide economies.

Why is Oil Price Volatility Important to Turkey?

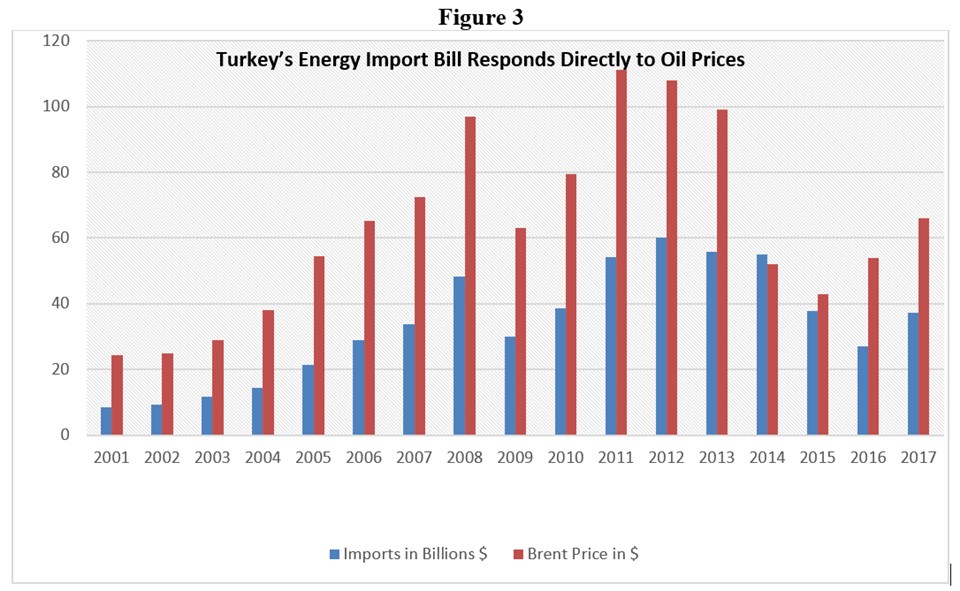

Turkey is an industrialized economy with a significant motor vehicle sector and has little domestic oil production relative to demand. In addition, Turkey’s energy import bill is directly tied to world oil prices in two ways. First, an increase in world oil prices directly affects the higher cost of oil needed for Turkey’s refineries. Second, the cost of Turkey’s natural gas imports also increases because of natural gas contracts that are indexed to oil prices.[12]

Figure 3

Source: Sabancı University Istanbul International Center for Energy and Climate

The Turkish motor vehicle industry is an important source of foreign reserve currency. For instance, in 2017, 80 percent of Turkish vehicle production (1.3 million automobiles, trucks, and heavy vehicles) was exported, bringing 29 billion dollars into the national economy.[13] Downturns of motor-vehicle sales, resulting from an oil price spike, would not only increase Turkish unemployment but also put stress on the Turkish lira, further decreasing Turkish households’ disposable income.

How to Prevent Oil Price Shocks

While oil supply interruptions were relatively common prior to the “energy crisis” of 1973, the world possessed substantial excess oil production capacity to offset unexpected outages. For example, after the Suez Crises of 1956, the US Texas Railroad Commission simply commanded higher oil production and world oil prices remained relatively stable. By 1973, when the Organization of Arab Petroleum Exporting Countries (OAPEC) embargoed oil shipments, the world’s spare production capacity had vanished.[14] The price spike after the OAPEC embargo caused a five percent slide in world economic growth during the following two years (from over six percent to one percent) and caused an economic recession in the Organization for Economic Co-operation and Development (OECD) countries. Juxtaposing the Suez Crisis and the OAPEC embargo vividly illustrates the difference between quickly replacing lost oil supplies versus suffering a loss in global oil supplies.

Various oil-saving strategies have been tried during past oil supply emergencies such as odd-even driving days,[15] programs to promote ride sharing or telecommuting, and use of public transportation. However, none of them reduced oil prices or prevented the economic damage caused by the oil supply outage. Therefore, the only effective remedy is to quickly offset the oil shortage with excess production capacity as was the case in the Suez Crisis. Absent excess world oil production capacity, the only way to offset losses is to possess and release strategic oil stocks in sufficient volume to replace lost supplies. Since the loss of excess world oil production capacity after 1971,[16] strategic oil stocks are the only effective defense governments have in order to protect their economies from oil price shocks.[17] If strategic reserves are large enough, and used, to replace lost oil supplies, they would keep the price of oil from spiking and, thus, avoid the economic harm that would otherwise be caused by the disruption.

Past Use of IEA Emergency Oil Reserves

Emergency oil reserves have never been used effectively to prevent past oil price spikes. While they did not exist for the 1973 and 1979 interruptions, by 1990 as a result of the International Energy Agency Treaty,[18] one billion barrels of government-held emergency oil reserves were available.[19] The Iraqi invasion of Kuwait occurred on 2 August 1990, curtailing seven percent of world oil production. Inexplicably, despite a sharp increase in oil prices, IEA emergency reserves were not used until 16 January 1991. Then, the first ever emergency drawdown of the US Strategic Petroleum Reserve (SPR) resulted in the sale of 17.3 million barrels of crude, a fairly small amount but this reflected the fact that, by 16 January 1991, oil prices were already falling from their October 1990 peak. By January 16, the restoration of Middle East oil production was widely expected. Therefore, the IEA/SPR release was unnecessary. An IEA/SPR release would have prevented the doubling of oil prices if it had been announced and executed in August 1990. One can also speculate that an early IEA Collective Action[20] would have prevented the 1991 recession in OECD countries as there was no obvious reason for it apart from the spike in world oil prices.

In 2017, 80 percent of Turkish vehicle production (1.3 million automobiles, trucks, and heavy vehicles) were exported bringing 29 billion dollars into the national economy.

Why were international oil reserves not used after the loss of Kuwaiti and Iraqi crude oil? There were concerns that an emergency release would have discouraged the use of OPEC excess production capacity and that Saudi production capacity might also be at risk from an Iraqi advance so the logic followed that emergency reserves should be saved in case there was an even greater loss than seven percent of world oil production. Despite these concerns, the US Department of Energy recommended that the Strategic Petroleum Reserve should be used promptly as part of an IEA Collective Action. Resistance by White House officials and bureaucratic inertia at the IEA continued to delay action until after oil prices had spiked and the resulting economic damage had been foreordained.[21]

The only other instance government oil reserves were used in response to an interruption in world oil supplies[22] occurred on 23 June 2011 when the IEA agreed to release a total of 60 million barrels of petroleum as a result of a loss of about 1.5 million barrels per day of Libyan light-sweet crude oil exports in February 2011; this was called the Libyan Collective Action. Despite the relatively small loss of global oil production (less than two percent of global oil supplies) and four million barrels per day of spare production capacity, Brent prices increased by approximately 20 dollars per barrel by April 2011.[23] By the date of the IEA/SPR release, oil prices were already declining. As with the 1991 release, with falling oil prices, an IEA Collective Action seemed pointless.[24] Others pointed out that the release would be beneficial because of the return of some refineries from seasonal maintenance. One day after the announcement of the IEA Collective Action, Brent crude prices did not change and, later, tightness returned to the market. A much larger Libyan Collective Action would have been more effective had it been announced in late February 2011, well before oil prices had peaked in April, instead of waiting until June. A variety of reasons have been offered for the tardy release, for example, whether an IEA stock release would signal markets that surplus production capacity could not replace lost Libyan supplies or that it would deter an increase of Saudi Arabian production.[25]

One insight gained from the Libyan Collective Action was that the role of the US SPR was no longer to just resupply lost oil to US refineries but to make oil also available to foreign refineries. The US SPR release simply allowed Nigerian light-sweet crude that had been imported to the United States to be exported to European refineries that had previously been Libyan oil customers. After the US SPR release, Nigerian crude oil shipments to the US declined by 700 thousand barrels per day, exactly matching the volume of the SPR release.[26]

The 1991 and 2011 SPR releases illustrate the difficulty in deciding if and when to have an IEA Collective Action. These releases demonstrate four important issues that can delay a quick response to a supply outage: Whether the supply disruption is of sufficient magnitude to justify the use of strategic reserves; whether IEA strategic reserves should be held in reserve lest the disruption becomes more severe; whether the release of IEA strategic stocks would discourage employment of OPEC spare production capacity; and the time that is required to achieve a consensus by IEA member countries to undertake a Collective Action.

Critics of IEA’s strategic stocks program, such as Taylor and Van Doren point out that “it has not been used frequently, robustly and quickly enough during the early stages of oil price shocks” and believe that “there is little reason to believe that the program’s dynamics will change in the future.”[27] Clayton[28] recognizes that even though emergency oil releases may not be effective in lowering oil prices as they “may have only a modest effect of prices and broader market forces can overwhelm them,” they may “be more effective at preventing harmful price spikes.” Consequently, tardy use of emergency stocks should be avoided. Also, as Clayton concludes, the threat of an oil stock release must be credible and “mixed signals from energy officials about a possible future release, as in July 2011, can make oil prices even more volatile.” Avoiding mixed signals and announcing a stock release before prices have spiked requires difficult decisions be made before a supply disruption has played out such as a quick consensus on how much the disruption is likely to raise oil prices. Even so, as noted by Jaffe and Soligo, there are “blurry lines,” before oil prices are high enough to justify a strategic stock release.[29]

The International Energy Agency Treaty

The IEA treaty requires its member countries to hold enough petroleum or petroleum products to replace 90-days’ worth of their imports. The treaty also requires member countries to participate in a stock release in proportion to their oil consumption. After a declaration of a petroleum supply emergency, an IEA Collective Action would compel member countries to release petroleum or petroleum products from their strategic reserves. The IEA estimated in 2010 that its member countries could release as much as ten million barrels per day in the first month following a disruption. This would decline to five million barrels per day five months after a disruption.[30]

Various oil-saving strategies have been tried during past oil supply emergencies such as odd-even driving days, programs to promote ride sharing or telecommuting, and use of public transportation.

While the IEA numbers may appear reassuring, it is far from clear whether current strategic oil reserves could prevent a supply outage from a large oil supply disruption. Questions remain regarding how quickly a decision would be reached to release the reserves, and once a decision is announced, how quickly the reserves could be made available to the market, and most critically, at what volume could the reserves flow into the world market. The IEA oil reserve system has never been tested at the levels that would be necessary to prevent an oil price spike after a serious supply interruption. It is also noteworthy that the most enforceable IEA treaty requirement is that member countries hold 90 days of their petroleum imports in government or industry stocks. This requirement made more sense during the 1970s when IEA member countries were heavily import dependent. Today, the IEA 90-day requirement would not prevent the United States from selling its entire SPR. Would industry stocks be sufficient to prevent an oil price spike after an emergency? They haven’t in the past. While higher-than-normal industry stocks would reduce the risk of a price spike after an oil supply interruption, they are no substitute for government-held strategic petroleum reserves. It is the prompt release of government-held reserves, equivalent to the volume per day as the loss of world oil supplies, which would prevent oil price spikes.

What Can Turkey Do?

Turkish emergency oil reserves, by themselves, cannot have a material effect on world oil prices. Becoming less dependent on oil use would certainly help, but this is a long-term solution. In addition, even with less Turkish oil use, an important vector of economic harm to the Turkish economy would come from a decrease in Turkish motor vehicle and other exports. Therefore, Turkey finds itself dependent, like most other IEA member countries, on the effectiveness of the IEA stockholding system for protection after an oil emergency. What Turkey and other IEA member countries can do is review the effectiveness of the current stockholding system, including a realistic assessment of the barrels per day that IEA reserves to quickly add to the world market, participate in the ongoing IEA emergency response exercises, and advocate early release of IEA strategic stocks when another serious oil supply disruption occurs.

Turkey finds itself dependent, like most other IEA member countries, on the effectiveness of the IEA stock holding system for protection after an oil emergency.

Conclusions

Strategic oil reserves can protect the worldwide economy if sufficiently large releases are promptly announced and executed. This would prevent the oil price spikes that would otherwise occur as a result of unplanned supply outages. Thus, governments should streamline procedures for a coordinated release of emergency stocks. Leaders of IEA member countries should be prepared to quickly evaluate the impact of any serious petroleum supply outage on petroleum prices and, if the supply disruption is estimated to cause an oil price spike, quickly reach an IEA consensus to release enough stocks to fully replace lost oil supplies. In order for emergency stocks to be effective, their certain use should be announced as quickly as possible to reassure markets and help emergency reserves flow into the market when they can do the most good.

[2] There was a sharp decline in growth from 1997 to 1998 (3.7 percent to 2.4 percent).

[3] Inappropriate monetary policy after an oil price shock may also explain the correlation between oil price shocks and GDP growth. This possibility is discussed and considered unlikely in Difiglio (2014).

[4] Paul Edelstein and Lutz Kilian, “How Sensitive are Consumer Expenditures to Retail Energy Prices?,” Journal of Monetary Economics, Vol. 56, No. 6 (2009), pp. 766-79.

[5] Danilo J. Santini and David A. Poyer, “Gasoline Prices, Vehicle Spending and National Employment: Vector Error Correction Estimates Implying a Structurally Adapting, Integrated System, 1949-2011,” (2013).

[6] James D. Hamilton, “What is an Oil Shock?” Journal of Econometrics, Vol. 113, No. 2 (2003), pp. 363-398.

[7] OECD oil and petroleum product stocks during 2014 through 2017 averaged about 300 million barrels above the normal range.

[8] Lorna A. Greening, David L. Greene, and Carmine Difiglio, “Energy Efficiency and Consumption – the Rebound Effect – A Survey,” Energy Policy, Vol. 28, No. 6-7 (2000).

[9] Carmine Difiglio, “Oil, Economic Growth and Strategic Petroleum Stocks,” Energy Strategy Reviews, Vol. 5 (2014) pp. 48-58.

[10] While a relatively small volume of biofuels is also consumed in the transport sector, they do not represent an opportunity to switch to another fuel as they are already part of the fuel supply system and biofuels cannot be produced in larger quantities to replace lost oil supplies during the time that replacements are needed.

[11] Axel Pierru, James L. Smith, and Tamim Zamrik, “OPEC’s Impact on Oil Price Volatility: The Role of Spare Capacity,” The Energy Journal, Vol. 39, No. 2 (2018).

[12] This impact on natural gas prices comes with a delay and only with a sustained price increase due to the 6-9 month moving average method.

[13] “Turkey’s automotive, automobile production hit all-time high in 2017,” Daily Sabah, 5 February 2018.

[14] Robert McNally, Crude Volatility: The History and the Future of Boom-Bust Oil Prices (New York: Columbia University Press, 2016).

[15] During the imposition of “odd-even driving days,” motorists are only allowed to drive on every other day dictated by whether their license plate ends on an odd or even number.

[16] A distinction is made here between excess production capacity and reserve production, the later requiring time to be put into production while the former is available for immediate production increase.

[17] Robert McNally (2016).

[18] The formation of the IEA involved a treaty among the member countries obligating them to participate in IEA’s strategic oil stocks program.

[19] “Oil Supply Security, Emergency Response of IEA Countries,” International Energy Agency, 2007.

[20] A “Collective Action” is the term the IEA uses to describe the release of IEA strategic petroleum stocks.

[21] Vito Stagliano, A Policy of Discontent, The Making of a National Energy Strategy (Oklahoma: PennWell, 2001).

[22] An IEA release also occurred in 2005 after Hurricanes Katrina and Rita disrupted 40% of US refining capacity. The purpose of this release was not to offset a shortfall of crude oil supplies but to provide additional refined products to the US market.

[24] International Energy Agency (2011), from first hand discussions at the IEA Standing Group on Emergency Questions.

[25] Blake Clayton, “Lessons Learned from the 2011 Strategic Petroleum Reserve Release,” Council on Foreign Relations Working Paper (2012).

[26] US law prevented the direct sale of SPR oil to foreign refineries but market forces caused an indirect sale to foreign refineries as US refineries used SPR oil instead of imported oil. In the case of the Libyan Collective Action, the swap involved light-sweet oil from one country, Nigeria. Going forward, since US oil imports are decreasing, these swaps will become more difficult. Fortunately, in December, 2015, US law was changed to allow export of US oil. This change would also allow the export of SPR oil.

[27] Jerry Taylor and Peter Van Doren, “The Case Against the Strategic Petroleum Reserve,” CATO Institute, 21 November 2005, p. 555.

[28] Blake Clayton (2012) “Lessons Learned from the 2011 Strategic Petroleum Reserve Release,” Council on Foreign Relations Working Paper

[29] Amy M. Jaffe and Ronald Soligo, “The role of inventories in oil market stability,” The Quarterly Review of Economics and Finance, Vol. 42, Issue 2 (2002), pp. 401-415.

[30] “Maximum Drawdown Capability of Public Stocks,” 130th Meeting of the IEA Standing Committee on Emergency Questions, International Energy Agency, 1 July 2010.