REUTERS

Today, the energy world is undergoing an inevitable transition to green energy alternatives. In this regard, it is essential to understand which global trends are driving energy transition. Energy demand is shifting towards the East; mainly China and Southeast Asia. According to the International Energy Agency’s (IEA) World Energy Outlook 2018 (WEO 2018),[1] in the year 2000, more than 40 percent of global demand was in North America and Europe and 20 percent was in Asia. This is expected to be reversed by 2040. For the last two years, the electricity sector has attracted the highest amount of investment compared to other sectors. Within the electricity sector, two-thirds of total installed capacity additions have come from renewables, setting a record high with 178 GW of additional capacity last year. For the first time, electric vehicles (EV) sales exceeded one million in 2017. The main motivation for these trends is decreasing unit production costs. Among most of the new energy technologies, EV battery costs have decreased fastest in recent years.

In the past, two main motivations were driving major energy discussions: security of supply and climate change. However, current discussions are evolving beyond these issues. New phenomena are emerging; namely, decarbonization, decentralization, digitalization, and diversity. Increasing awareness led to innovations on both institutional and technical fronts. These innovations made energy markets more resilient through better pricing, new and cleaner technologies, and increased energy efficiency. New sustainable solutions and demand responses were also incorporated into the policies of many countries. While major transformations are underway, the global energy sector is also facing tremendous challenges. These include fundamental changes in market design and business models through decentralization and digitization. There are still remaining questions over electrification’s capacity to meet demand and the availability of power systems.

In the past, two main motivations were driving major energy discussions: security of supply and climate change.

The recent trade-related turmoil in the world and its effects on the energy sector have brought energy security into prominence, particularly for energy importing countries. Energy security largely depends on sufficient investments. The IEA’s World Energy Outlook highlights that investment decisions taken today determine how energy supply and demand will unfold tomorrow. The report mentions that a 44 trillion dollar investment in the global energy supply and 23 trillion dollars in energy efficiency is required to cover the estimated growth in energy demand through 2040. Foremost among the prerequisites to attract investment is a political and regulatory certainty.

There are also major uncertainties emanating from both the rapid market changes and the geopolitical dimensions of unconventional gas and LNG supply. Moreover, how a possible renegotiation process of the Paris Agreement will shape the future of climate talks remains an open question. Beyond uncertainty in energy and environmental policy, we are also experiencing uncertainties in other policy areas at global and regional levels including trade, monetary, security, and immigration.

In line with the global transition discussed above, Turkey has also gone through a major transition since 2002, which I refer to as Transition 1.0 throughout the article. Opening the market to competition while meeting the increasing demand was not an easy process, but I believe that strong political commitment, vision, and stability made it possible. During this transformation, the government’s role has shifted more towards regulation and policy-making. In 2017, 16 years following the first transition period, the Ministry of Energy and Natural Resources announced its National Energy and Mining Policy. I call this policy Transition 2.0 due to its comprehensive approach ranging from energy to industry to employment.

Turkish Energy Transition 1.0

Turkish energy markets can be described by two main characteristics which are also the major challenges being faced. The first one is a growing demand. According to the IEA, Turkey will likely see the fastest medium to long-term growth in the field of energy among IEA member countries, while the second challenge in the market is the dependency on imports. Import dependency ratio is almost 70 percent in primary energy resources.

To meet this growing demand while dealing with import dependency, Turkey decided to transform its energy markets and started implementing major market reforms. The main objectives were to establish financially viable, stable, transparent, and competitive markets under independent regulation to ensure reliable and affordable energy supply to consumers in an environmentally friendly manner. These objectives are based on several laws and covering most aspects of the relevant European Union (EU) acquis. According to the EU’s Turkey 2018 Report,[2] “Turkey has continued to align with the EU acquis. As regards the internal energy market, good progress was made on the electricity market and good progress can be reported on renewable energy and energy efficiency.”

During the last 16 years, the Turkish power market attracted more than 60 billion dollars in investment. Whole investment was made by domestic and foreign private companies. In addition, the entire distribution system was privatized through the transfer of operating rights for the next 30 years. In the last 16 years, total installed capacity has grown from 30 GW to 88 GW. More importantly, the share of Independent Power Producers (IPPs) in the market went up from 25 percent to more than 75 percent. These have all been achieved without any long-term purchasing power agreements and only through renewable feed-in-tariffs. Just last year, 8222 MW capacity was added with over 50 percent of renewables. Additionally, Turkey integrated its power network with the European network and neighboring countries’ grid during the same period. The integration helps to expand the ability of peak load management, reduce strain on the grid, and limit the use of the more expensive and often least efficient plants.

During Transition 1.0, market activities were unbundled and the vertically integrated state monopoly model was turned into a well-functioning competitive market model together with the privatization of generation and distribution assets.

Turkish Energy Transition 2.0

The points discussed above refer to past developments and achievements, but the reality is that Turkish energy markets are still in a transition period. Liberalization and intensive investments are ongoing amidst climate change challenges and sustainability and security concerns.

The Ministry of Energy and Natural Resources announced a comprehensive policy in 2017: The National Energy and Mining Policy (NEMP). The new approach brought by these policies marks the second transition period, Transition 2.0, of the Turkish energy market. This policy clearly defined the strengths, shortcomings, threats, and opportunities of the Turkish energy sector. Based on detailed analyses, NEMP was established based on three main pillars: security of supply, localization, and predictability in the markets.

During the last 16 years, the Turkish power market attracted more than 60 billion dollars in investment.

Investment in infrastructure is essential to maintain security of supply. For infrastructure investment in the energy market, Turkey is investing extensively in power grids both at the transmission and distribution levels. When it comes to the gas market, the main objective is to make gas networks and relevant facilities capable of delivering more gas in any direction with the least cost. Investments in the energy sector must continue to meet growing energy demand and ensure a sustainable energy future. In line with this goal, there are three priorities for the energy sector in the upcoming period: financial sustainability, political sustainability, and inclusiveness. These three policy aims are the key elements of a viable investment environment. Turkey has been experiencing the results of these policies for the last decade. According to the World Energy Trilemma Index 2018,[3] an annual report published by the World Energy Council, “Turkey's energy security score has improved relative to other countries and as part of the measure of supply diversity.” According to the report, Turkey’s energy security rating in 2018 rose 15 places, compared to last year.

Through predictability in the markets, Turkey aims to achieve a more competitive structure in the energy sector and create the right price signals for investors. Right price signals are crucial due to their power to translate into affordable energy prices for households, the commercial sector, and the industry. Delivering affordable prices to our industry would, in turn, enable the sector to become more competitive in the global arena.

The third dimension of NEMP is localization. Turkey is increasing the relatively low share of domestic coal in its energy mix through clean coal technologies. In renewables, Turkey has even more ambitious goals. Renewable energy sources are steadily increasing its share in the world energy mix. Given the concerns regarding climate change, the world energy sector has been in a transition for more than a decade. Taking into account the potential of renewable energy sources to mitigate greenhouse gas emissions, almost all countries in the world prioritized renewable energy in their agenda. Turkey has also successfully utilized renewable sources. After triggering renewable energy investments through feed-in tariffs-based renewable energy sources support mechanism (YEKDEM), elaborated in December 2010, Turkey announced a new strategy. This entails a “renewable energy resource zone (RE-ZONE) competition mechanism,” which encourages investors not only to build power plants but also to manufacture renewable energy equipment in Turkey. Through our newly established RE-ZONE model, we are aiming to both utilize renewable resources and at the same time reduce our current account deficit with locally manufactured content requirement. Additionally, the projects will bring new employment opportunities into the region, as well as business opportunities to our small and medium-sized enterprises.

With the realization of RE-ZONE projects, Turkey will be one of the renewable energy technologies and equipment supplier countries in its region.

Two RE-ZONE competitions of solar and wind for 1,000 MW each were completed with historic low prices. The installed capacity of renewable energy sources excluding hydro has reached 13,328 MW, representing 15 percent of the total installed capacity by the end of August 2018. With the realization of RE-ZONE projects, Turkey will be one of the renewable energy technologies and equipment supplier countries in its region. Currently, installed wind capacity for wind and solar is around 7,000 MW and 5,000 MW, respectively. Turkey is planning to add 1,000 MW capacity for each solar and wind, annually, adding 20,000 MW of wind and solar capacity in total within 10 years. In addition, 28,133 MW of hydro capacity is planned to be increased to 34,000 MW, during the same period. Turkey also has targets to utilize geothermal and biomass sources to the energy mix with a capacity of 1500 MW and 1000 MW, respectively.

Within the scope of NEMP, strategies prioritizing energy security, domestic resources, market predictability, and strengthening international collaborations were put into effect. The recent plans and developments were implemented according to these policies.

Recent Plans & Developments

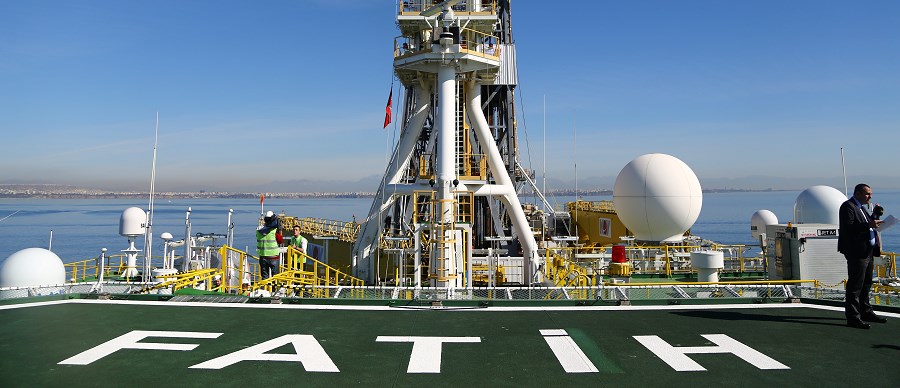

According to the IEA, fossil fuels will continue to be the world’s primary energy sources until 2040. As Turkey is a net oil and gas importer, recent policies have a particular focus on hydrocarbon exploration. Deep-sea drilling activities are being conducted by Fatih drilling vessel initiated in the Mediterranean since September 2018. A second deep-sea drilling vessel is planned to start its activities in the upcoming months. In addition, Barbaros Hayrettin Paşa and Oruç Reis vessels will continue offshore seismic studies in the Black Sea and Mediterranean. The Eastern Mediterranean is a promising region considering the recent oil and gas discoveries. Any finding of oil or gas reserves would support Turkish energy security and in case of reaching a significant reserve, this would be a game-changer for the region.

Globally, we are witnessing changing dynamics in the gas market as well. Following the shale revolution in the US, new explorations in the Mediterranean and other regions make gas not only abundant but also competitive. Flexibility is enhancing in all aspects including contract durations, take or pay requirements and pricing formulas. For instance, contract durations tend to get shorter and hub-pricing is replacing oil-indexed prices.

Apart from the exploration activities, Turkey made important enlargements to its natural gas infrastructure. We currently have two underground storage facilities, Silivri and Tuz Gölü, with a total capacity of 3.3 bcm. Private companies, as well as BOTAŞ, will continue to make investments to expand our underground storage capacity. Two floating storage regasification units (FSRU) were commissioned in 2018. With the expansion of the two existing LNG terminals, total LNG injection capacity has reached 117 mcm per day. Furthermore, the transmission capacity of natural gas networks has extended to more than 300 mcm per day with a target to reach 400 mcm per day with future extensions. Turkey also aims to increase its natural gas storage capacity to at least 20 percent of its annual consumption.

Domestic coal and lignite constitute only 13 percent of Turkish total energy mix. Turkey has approximately 18.5 billion tons of coal reserves. Although our domestic coal has its own technical challenges, we recently had a very successful tender for 800 MW Çayırhan Thermal Power project. Considering the developments regarding clean coal technologies, Turkey has plans to tender certain fields for using electricity generation up to 5,000 MW. Furthermore, studies concerning liquefaction, gasification, and enrichment of domestic coal are ongoing. Turkey has firm plans for adding nuclear power to its energy mix. The Akkuyu province in Mersin was selected as a location for the first nuclear power plant which will be called Akkuyu Nuclear Power Plant (Akkuyu NPP). Akkuyu NPP is designed under a Build-Own-Operate model and will have 4,800 MW total capacity within four units. The construction license of Akkuyu NPP was granted and the first unit is planned to become operational by 2023. A new regulatory authority was established to regulate the nuclear energy sector.

Energy saving and energy efficiency initiatives can significantly contribute to energy security, the mitigation of import dependency risks, the protection of the environment, and combatting climate change. Energy saving and energy efficiency can be considered as alternative energy sources which are crucial elements of national strategies and energy policies of 2023. Turkey announced the National Energy Efficiency Action Plan in early 2018 which sets out actions to implement a reduction of 14 percent of primary energy consumption by 2023, via a strategy which includes 10.9 billion dollars of planned investment. The return of total projected investment is expected to be 30 billion dollars until 2033. Sectoral measures set out in the plan include buildings and services, energy, transport, industry and technology, agriculture, and cross-cutting areas. According to the plan, Turkey aims to save 23.9 million tonnes oil equivalent of its final energy consumption.

Concluding Remarks

This article has discussed Turkey’s strategies and actions driving its energy transition. Many of these ambitious plans prioritize securing energy supply, reducing adverse economic impacts of increasing energy imports, making markets more competitive, and increasing investments primarily on renewable energy on both a small and large scale. In this regard, I would like to point out major areas that will shape the country’s energy transition and provide opportunities for new investments:

- Offshore exploration of oil and natural gas activities will continue. Turkish Petroleum will be more active in drilling operations in the near future.

- We are expecting national oil and gas exploration and production companies to become very active through international partnerships.

- Assets have recently become very attractive to foreign investors. Therefore, many mergers and acquisitions are expected to occur in the near future.

The Turkish energy market has gained a lot of maturity in terms of competitiveness primarily due to successful market reforms carried out during transition periods. Therefore, any new player planning to enter the market, whether through an LNG, nuclear, natural gas or renewables project should be competitive. Additionally, some of our gas supply contracts are expiring in 2020. Thus, we are at a very important stage to renegotiate or make new contracts on competitive terms.

Finally, our approach to new projects is based on three main principles according to which all stakeholders should mutually benefit and all risks should be fairly allocated. More importantly, any project should contribute to Turkey’s national and regional supply security as well as to regional peace, stability, and prosperity.

[1] International Energy Agency, “World Energy Outlook 2018,” https://www.iea.org/weo2018/

[2] European Commission, “Commission Staff Working Document: Turkey 2018 Report,” 17 April 2018, https://ec.europa.eu/neighbourhood-enlargement/sites/near/files/20180417-turkey-report.pdf

[3] World Energy Council, “World Energy Trilemma Index 2018,” October 2018, https://www.worldenergy.org/publications/2018/trilemma-report-2018/