From the Balearic Islands and Corsica, to Sicily in the Mediterranean, the European Network of Transmission System Operators-Electricity (ENTSO-E) transmission system interconnects continental Europe with its islands. Cyprus Island, which has a strategic geopolitical location in the Eastern Mediterranean right at the south of Turkey, is one of the few islands left without any interconnection. Why would anyone want to connect Cyprus Island to a greater energy network such as electricity or natural gas? I will strive to seek an answer to this question with its implications on the island and the Eastern Mediterranean from an economic and a geopolitical perspective.

Economic Overview of Cyprus Island

Cyprus Island is the third biggest island after Sicily and Sardinia with a total surface area of 9,251 km2. 3,355 km2 of the area belongs to the Turkish Republic of Northern Cyprus (TRNC) while the rest belongs to the Greek Cypriot Administration (GCA). Approximately 1.2 million people live on the island in total - 285,000 people on the northern side[1]and 865,000 people on the southern side.[2]The economy of the island mostly relies on tourism. This is important for two reasons: first of all, the number of tourists visiting the island increases dramatically during the summer and secondly, summer is extremely hot in the island therefore the need for air-conditioning increases substantially. As a result, the increase in demand for electricity leads to power outages due to the lack of sufficient local generation.

As shown in Table 1, the economic magnitude of the GCA in 2014 was 21,62 billion dollars. While the GCA’s economic growth rate fluctuated between -2 percent and 2 percent between 2009 - 2019-Q1,[3]the economic growth of the TRNC fluctuated between -6 percent and 6 percent between 2008-2017.[4]Moreover, in 2014, 113 percent of the GDP of GCA was public debt, impairing the capacity of the central government to provide capital for large infrastructure investments. With its small economic scope, the TRNC faces the same situation. As a result, the Island’s economy does not allow high capital investments such as natural gas exploration or large scale power plant and interconnection investments at transmission voltage level. Essentially, both sides of the island need foreign capital for such investments.

Table 1: Eastern Mediterranean Countries Main Indicators[5]

|

Country

|

Egypt

|

Israel

|

GCA

|

Lebanon

|

|

Overview

|

|

|

|

|

|

Surface Area (km2)

|

1.000.000

|

20.770

|

9.251*

|

10.400

|

|

Population (million)

|

88,5

|

7,8

|

1,2

|

6,0

|

|

Economy (2014)

|

|

|

|

|

|

GDP (PPP) (billion US$)

|

946,6

|

268,3

|

21,62

|

64,3 (2013)

|

|

GDP per capita (PPP) (US$)

|

10.900**

|

33.400

|

24.500

|

15.800

|

|

Sectors (Share in GDP)

|

|

|

|

|

|

|

Services

|

45,6

|

66,4

|

81,7

|

75,4

|

|

|

Industry

|

39,9

|

31,2

|

15,9

|

20,0

|

|

|

Agriculture

|

14,5

|

2,4

|

2,4

|

4,6

|

|

|

Economic Indicators (2014)

|

|

|

|

|

|

|

Economic Growth (%)

|

2,2

|

3,3

|

-2,8

|

1,5

|

|

|

Share of Taxes in GDP (%)

|

22,9

|

40,2

|

40,4

|

21,8

|

|

|

Public Debt to GDP (%)

|

93,7

|

67,1

|

113,1

|

120,0

|

|

|

Inflation Rate (%)

|

10,1

|

1,7

|

0,2

|

5,0

|

|

| |

|

|

* 3.355 km2 of the total belongs to TRNC

|

|

|

|

|

|

|

** Forecast

|

|

|

|

|

|

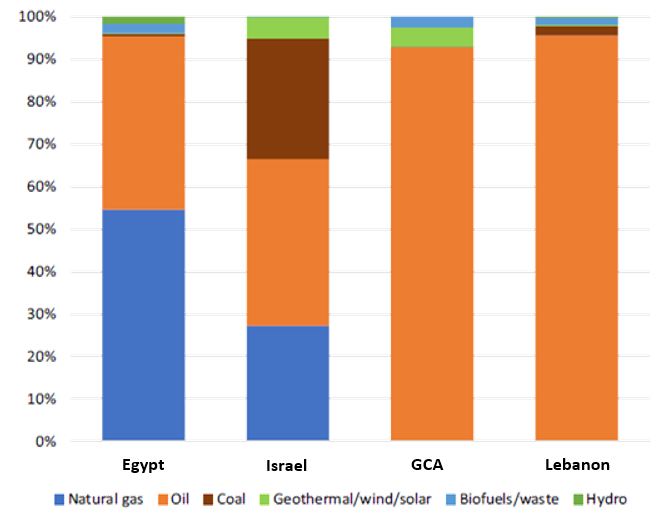

A total analysis of the primary energy resources will aid in contextualizing this article. Similar to Lebanon, Cyprus Island also relies on oil for its economy. The share of renewables such as geothermal, wind, solar, biofuels, and waste is less than four percent, which is quite low. Furthermore, heavy dependence on oil as a primary energy resource brings environmental concerns due to its high carbon emissions. Cyprus island will have to transform its energy resources to renewables to reach EU’s target[6]of net-zero-carbon-emission by 2050.

Figure 1: Share of Primary Energy Sources in Total (2014)[7]

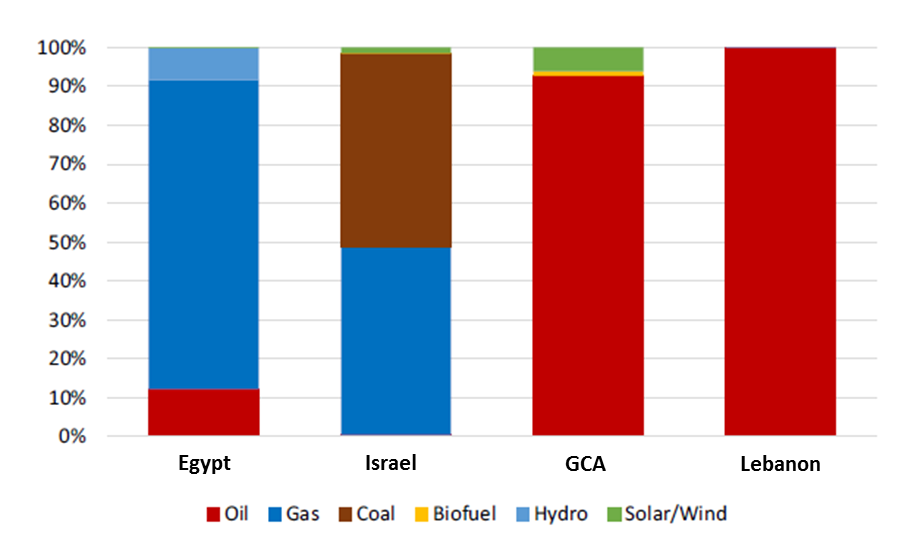

As seen in Figure 2, the GCA generates 92 percent of its electricity from oil as a primary energy source. This percentage is even higher in the TRNC. Thermal Power installed capacity in GCA is 1478 MW as of 2018.[8]Additionally, 157.5 MW wind power plant and around 10 MW biomass power plant is technically operational. Despite this, the wind power plant is not fully utilized due to reserve capacity constraints. TRNC, on the other hand, has an installed capacity of 409 MW as of 2018. However there is only 1 MW of solar installed capacity in the portfolio and the rest depends on thermal resources.[9]

Although the Island’s potential in solar energy is recognized, only a small portion of their electricity is generated from renewable resources such as wind, solar, and biofuel. This is economically damaging for consumers since electricity is very expensive compared to other European countries, and electricity prices are extremely volatile due to their dependence on the frequently fluctuating global oil market. Price volatility in electricity prices poses a significant problem for the people of Cyprus Island and brings substantial challenges for any administration in terms of public satisfaction.

Figure 2: Share of Primary Energy Sources in Electricity Generation (2014)[10]

Electricity Prices in Cyprus Island

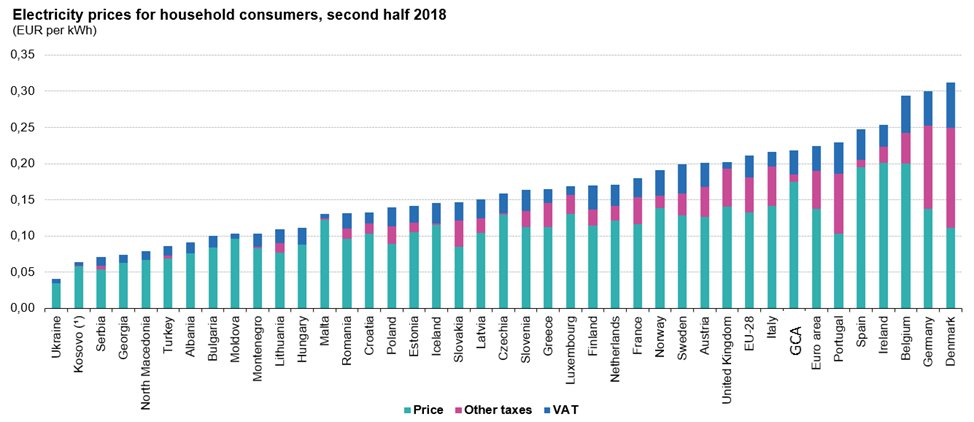

Extremely high electricity prices in Cyprus Island may not drop to European price levels unless there is an interconnection investment or a complete transformation of the generation portfolio from expensive oil power plants. Any alternative project to serve this goal should be economically the most efficient one. Since none of the administrations on the island are able to finance such a capital intensive investment, a foreign investment would be necessary to follow through the project. Ultimately, a foreign investor will require its expenses to be reflected to the system usage fee tariffs, which should be reimbursed by the people of Cyprus Island. Therefore, despite the already high electricity prices, the final prices will be even greater as a result of system usage fees.

As demonstrated in Figure 3, electricity prices, including taxes, for household consumers in Turkey are the cheapest compared to EU member countries. Only non-members such as Ukraine, Kosovo, Serbia, Georgia, and North Macedonia have lower prices. On the other hand, electricity prices of GCA is above 28 of the EU countries and only cheaper than six. In 2018, Turkish households paid only eight Euro-cent per kWh of electricity whereas Greek Cypriot households paid almost 23 Euro-cent per kWh of electricity which is three-fold of Turkish consumers.

Figure 3: Electricity Prices for Household Consumers, second half of 2018[11]

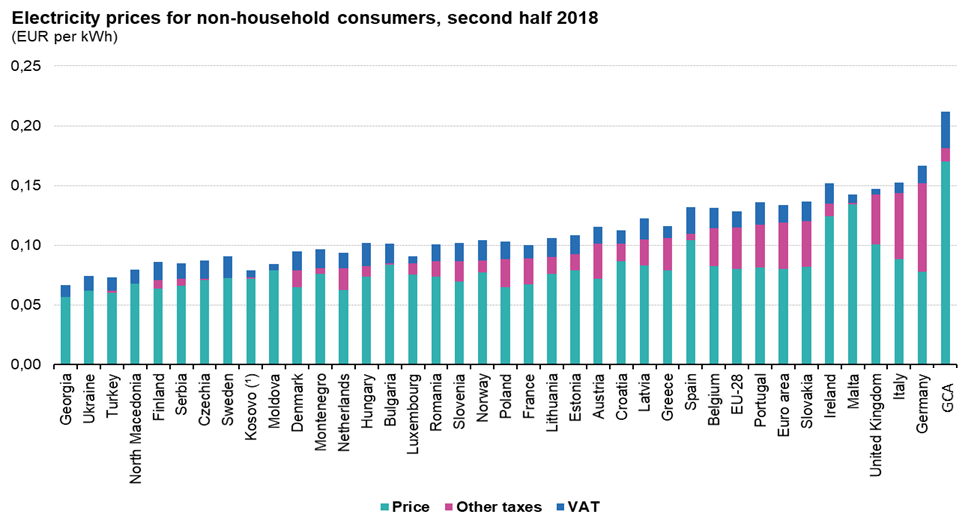

Numbers are even more astonishing for non-household consumers. Electricity prices, including taxes, for non-household consumers in Turkey are the cheapest in comparison to the EU member countries, whereas the GCA’s electricity prices are the most expensive amongst all European countries. Figure 4 shows that Turkish non-household consumers paid only seven Euro-cent per kWh of electricity while Greek Cypriot non-household consumers paid as much as three times, with a rate of 22 Euro-cent per kWh of electricity in the second half of 2018. The Island’s extremely high electricity prices are a direct consequence of the excessive costs of fuel-oil power plants.

Figure 4: Electricity Prices for Non-Household Consumers, second half of 2018[12]

Electricity prices are also very high in the TRNC compared to European countries, although still remain lower than GCA levels. Summer tariffs for household consumers in 2019 differentiate between 10 Euro-cent per kWh and 21 Euro-cent per kWh according to the time of the day and day of the week.[13]

Alternative Interconnection Projects

The Cyprus Island has two tangible transmission interconnection projects in order to have access to the European transmission system, namely ENTSO-E. Turkey-Cyprus Island (TCI) Interconnector has clear advantages over EuroAsia Interconnector in economical, technical, legal, and geopolitical aspects.

The EuroAsia Interconnector will start near Hadera in Israel and take the submarine route to Cyprus Island where it will connect at the Kofinou station. Afterwards, it will continue towards the western route and take a submarine route to Korakia point in Crete, Greece and from there will continue to Attica, mainland Greece. The EuroAsia Interconnector is planned to be 1518 kilometers long, with three sections. Israel-Cyprus Island section is 310 kilometers, Cyprus Island-Crete section is 879 kilometers, and Crete-Attica section is 329 kilometers. Its lowest submarine point will be 3,000 meters below sea-level. In order to avoid technical difficulties with the planned route due to the structure of the sea ground, submarine cables must be placed at this depth. The capacity of the interconnector is planned to be 2000 MW. It will serve both directions between Europe and the Eastern Mediterranean.

The project is planned to be completed in 2023 December. There are significant economical, technical, and legal/geopolitical barriers against the project. Furthermore, the initial transmission capacity of 1000 MW at Stage one is estimated to be 3.5 billion Euros,[14]which is a disproportionate investment considering the relatively small capacity that will travel over 1500 kilometers.

United Nations Convention on the Law of the Sea (UNCLOS) is the superior legal reference signed by more than 150 countries and came into effect on 16 November 1994. UNCLOS grants the coastal states the right to exercise sovereignty or certain rights within a number of maritime zones adjacent to their land territory. Moreover, it regulates the passage of submarine cables and pipelines through maritime zones. Legally and geopolitically, the fact that the EuroAsia Interconnector will pass through the Exclusive Economic Zone (EEZ) claimed by Turkey causes conflict. Although Turkey has not signed the convention, it affects its arguments.

Therefore, Article 58 and Article 79 of the UNCLOS are worth examining. Article 58 regulates the rights and duties of other States in the EEZ, whereas Article 79 regulates submarine cables and pipelines on the continental shelf. The first clause of the Article 58 states that “In the exclusive economic zone, all States, whether coastal or land-locked, enjoy, freedoms of submarine cables and pipelines.” While the first clause of Article 79 states that “All States are entitled to lay submarine cables and pipelines on the continental shelf, in accordance with the provisions of this article.” The second clause of the same article states that “the coastal State may not impede the laying or maintenance of such cables or pipelines.”[15]Ultimately, these three clauses imply free passage for submarine cables and pipelines without the consent of the coastal state.

However, the third clause of Article 79 implies just the opposite. It states that “The delineation of the course for the laying of such pipelines on the continental shelf is subject to the consent of the coastal State.”[16]Consent of the coastal state is the legal prerequisite for laying the pipelines or submarine cables. Finally, the fourth clause of the same article gives some additional authority to the coastal state by stating “Nothing in this Part affects the right of the coastal State to establish conditions for cables or pipelines entering its territory or territorial sea, or its jurisdiction over cables and pipelines constructed or used…”[17]

Greece claims that its EEZ is in the Eastern Mediterranean with reference to the maritime zones of the Dodecanese islands including Meis (Kastellorizo) Island, which lies only a couple of nautical miles off the Turkish coast. The Greek claim substantially contracts the EEZ and continental shelf claimed by Turkey. According to Greek opinion, the EuroAsia Interconnector passes through Greek EEZ rather than Turkish EEZ.

Turkey, on the other hand, claims its EEZ with reference to the equidistance/median line with Egypt, which passes through the southern coast of Cyprus Island and intersects with the projected EuroAsia interconnector route.[18]Therefore, any attempt to construct the route would be met with legal objections from Turkey and even retaliation from the Turkish navy to defend the country’s territorial waters. As a result, serious legal and geopolitical risks arise for the EuroAsia Interconnector due to the legal ambiguity regarding the free passage of submarine cables and disagreement in relation to the delimitation of the maritime zones.

The economic, technical, legal, and geopolitical barriers of the EuroAsia Interconnector automatically elevate the feasibility of the TCI Interconnector which will only be 80 to 100 kilometers long in comparison and will not pass through deep sea, ultimately costing much less, considering the 1200 kilometer length of its rival excluding the Cyprus Island- Israel section. Turkey has already signed an interconnection agreement with TRNC in 2016 and TRNC already has an interconnection with GCA.

The 200 MW TCI Interconnector capacity will suffice to avoid electricity interruptions and improve renewable power plant utilization. 80 MW installed capacity will provide full utilization of wind power plants in the south. 120 MW capacity will serve TRNC energy policy of keeping at least a 100 MW reserve capacity in the system,[19]avoid black-outs on both sides of the island, and even enable further renewable investments in the north.

The TCI Interconnector would also satisfy the European Council’s interconnection target rate since it will be equal to 10 percent of approximately 2000 MW total installed capacity of Cyprus Island. In October 2014, the European Council called for all EU countries to achieve electricity interconnection of at least 10 percent of their installed production capacity by 2020.[20]

Greek Cypriots would object the interconnector due to political concerns regardless of the project contributing to the peace process on the island, considering the fact that French island Corsica is interconnected to Italian mainland rather than French mainland.

How to Finance the Transmission Interconnection Infrastructure

According to EU law, five separate criteria must be met in order to be eligible for the list of Projects of Common interest (PCIs):[21]

- Have a significant impact on at least two EU countries

- Enhance market integration and contribute to the integration of EU countries' networks

- Increase competition on energy markets by offering alternatives to consumers

- Enhance security of supply

- Contribute to the EU's energy and climate goals - they should facilitate the integration of an increasing share of energy from variable renewable energy sources

The TCI Interconnector apparently fulfills all these criteria which would entitle it to be named as a Project of Common Interest by the EU, thus financing with lower interest rates and longer terms would be available to investors.

To begin with, Cyprus Island is currently an energy island and thus it would undoubtedly enhance market and network integration for other EU countries. Turkey will provide the missing link between Cyprus Island-Greece and Cyprus Island-Bulgaria while also being interconnected with the ENTSO-E system via Bulgarian and Greek borders. In that sense, the TCI Interconnector will have a significant impact on at least three EU members.

Secondly, Cyprus Island will be connected not only to continental Europe but even to the UK, Russia, and Morocco via Turkey as well. This will enable increased competition due to the existence of electricity from different sources. Turkish Independent Power Producers or State Company EUAŞ would provide electricity to the Island. There would be bilateral agreements between companies for determined terms. Moreover, mutually organized markets would be established where electricity is traded on spot and in future markets.

Furthermore, the TCI Interconnector will improve supply security for Cyprus Island as supply falls short of demand in the Greek and Turkish parts of the island from time to time. On another note, the TCI Interconnector will also provide reserve capacity which is an indispensable prerequisite in order to promote renewable power plants, such as wind and solar.

One might claim that the EU would not support the TCI Interconnector because its rival, the EuroAsia Interconnector, is already entitled as a Project of Common Interest. However, it is likely that this argument will only remain valid temporarily. Once the economic, technical, legal, and geopolitical barriers against EuroAsia are recognized, one can anticipate that the TCI interconnector will be acknowledged as the only feasible option.

Benefits of the Turkey – Cyprus Island Interconnection Project

The explosion on 11 July 2011 at the Mari naval base adjacent to Vasilikos Power Station, as a result of which power generation halted completely due to the heavy damage experienced, was an unfortunate incident that provided valuable insight into comprehending the potential of the Turkey-Cyprus Island Interconnection Project. Consequently, TRNC provided GCA’s electricity in 2011 and 2012. Following this incident, Turkish Cypriots and Greek Cypriots signed an agreement for the reconnection of three pre-existing power lines, synchronizing the two communities’ electricity grids in January 2016.

This agreement served three outcomes:[22]firstly, Greek Cypriots supplied cheap Turkish Cypriot electricity; secondly, blackouts decreased on the Turkish Cypriot side. Arguably, the most impressive result was that the utilization rate of renewables increased. Greek Cypriots have an installed capacity of 157.5 MW wind power plant, however, before the interconnection agreement with TRNC, they were able to only utilize 66 MW of the total capacity. After the agreement, utilization rate increased by 20 percent to 80 MW. This significant increase serves as a strong indicator of how interconnection capacities could contribute to the promotion of renewable energy all over the island, particularly where solar and wind have a high potential.

Turkey-Cyprus Island Interconnector would provide several benefits to Turkey, both sides of the Island, and even EU, such as:

- Enhancing supply security, and thus preventing black-outs in Cyprus Island

- Significantly decreasing the electricity prices in Cyprus Island due to the considerably cheaper electricity prices in Turkey

- Promoting renewable energy investments, as it would provide available reserve capacity that could be instantly adjusted. As a result, the promotion of renewables would also contribute to “climate neutral Europe/net-zero emissions by 2050” target of the EU and be environmentally beneficial

- Serving the European Energy Union objective of integrated EU markets and networks[23]

- Satisfying the European Council’s interconnection target rate since it would correspond to 10 percent of Cyprus Island’s approximately 2000 MW total installed capacity

- Turkish companies would take advantage of the price spread between Turkey and Cyprus Island while also enjoying additional profit margins on top of the Turkish market

- Possibly contributing to the solution of the Cyprus Issue

- Possibly presenting a solution to the deadlock in the Eastern Mediterranean, which obstructs mutual exploitation and the utilization of hydrocarbon resources

- Possibly providing certain leverage to Turkey for the energy negotiations regarding Eastern Mediterranean hydrocarbon resources due to its contribution to supply security and the transformation of generation structure

- Contributing to broader regional cooperation in case further extension of TCI Interconnector to Israel is realized

- Bolstering the geopolitical position of Turkey in the Eastern Mediterranean

[1]Kuzey Kıbrıs Türk Cumhuriyeti Başbakanlık Devlet Planlama Örgütü [Turkish Republic of Northern Cyprus Primeministry Planning Organization], “2017 Yılı Ekonomik ve Sosyal Görünüm’’ [Economic and Social Outlook of 2017], November 2018, http://www.devplan.org/2017%20EKO-SOS-GOR.pdf

[2]Eurostat, “Population Projections,” 21 August 2019, https://ec.europa.eu/eurostat/databrowser/view/tps00002/default/table?lang=en

[3]Trading Economics, “Cyprus GDP Growth Rate,” 23 June 2019, https://tradingeconomics.com/cyprus/gdp-growth

[4]Kuzey Kıbrıs Türk Cumhuriyeti Başbakanlık Devlet Planlama Örgütü (2017).

[5]Isabella Ruble, “European Union Energy Supply Security: The benefits of natural gas imports from the Eastern Mediterranean,”Energy Policy, Vol. 105, Issue C (2017), pp. 341-53.

[6]European Commission, “The Commission calls for a climate neutral Europe by 2050,” November 2018, http://europa.eu/rapid/press-release_IP-18-6543_en.htm

[8]Electricity Authority of Cyprus, https://www.eac.com.cy/EN/EAC/Operations/Pages/Generation.aspx

[9]Kıbrıs Türk Elektrik Kurumu [Cyprus Turkish Electricity Institution], “KKTC’de Elektrik Üretim Santralleri” [Electricity Production Powerplants in GCA], 2019, https://www.kibtek.com/uretim/

[11]Eurostat, “File: Electricity prices for household consumers, second half 2018,”2018, https://ec.europa.eu/eurostat/statistics-explained/index.php?title=File:Electricity_prices_for_household_consumers,_second_half_2018_(EUR_per_kWh).png

[13]Cyprus Turkish Electricity Institution (2019).

[14]EuroAsiaInterconnector, “EuroAsia Project Schedule,” https://www.euroasia-interconnector.com/at-glance/project-timeline/

[15]“United Nations Convention on the Law of the Sea,” 10 December 1982, https://www.un.org/Depts/los/convention_agreements/convention_overview_convention.htm

[18]United Nations General Assembly, “A/73/804,” 22 March2019, https://undocs.org/en/A/73/804

[19]Cyprus Turkish Electricity Institution (2019).

[20]European Commission,“European Topics,”https://ec.europa.eu/energy/en/topics/infrastructure/projects-common-interest/electricity-interconnection-targets

[21]European Commission, “Questions and answers on the projects of common interest (PCIs) in energy and the electricity interconnection target,” 2019, https://europa.eu/rapid/press-release_MEMO-17-4708_en.htm

[22]Mathew Bryza, “East Med Energy: Restoring Squandered Opportunities,” Turkish Policy Quarterly, Vol. 17, No. 3 (2018), p. 87.

[23]Mustafa Özge Özden, “European Energy Union,” Turkish Energy Foundation (TENVA) Energy Panorama, Vol. 22, No. 22 (2015), pp. 40-45.